Motivation. The real business cycle model asserts that all the cycles are caused by changes in or:

def. Solow Residual (=Total Factor Productivity, TFP). Simply defined as from the Intertemporal Consumption-Leisure Optimization (Full General Equilibrium) model.

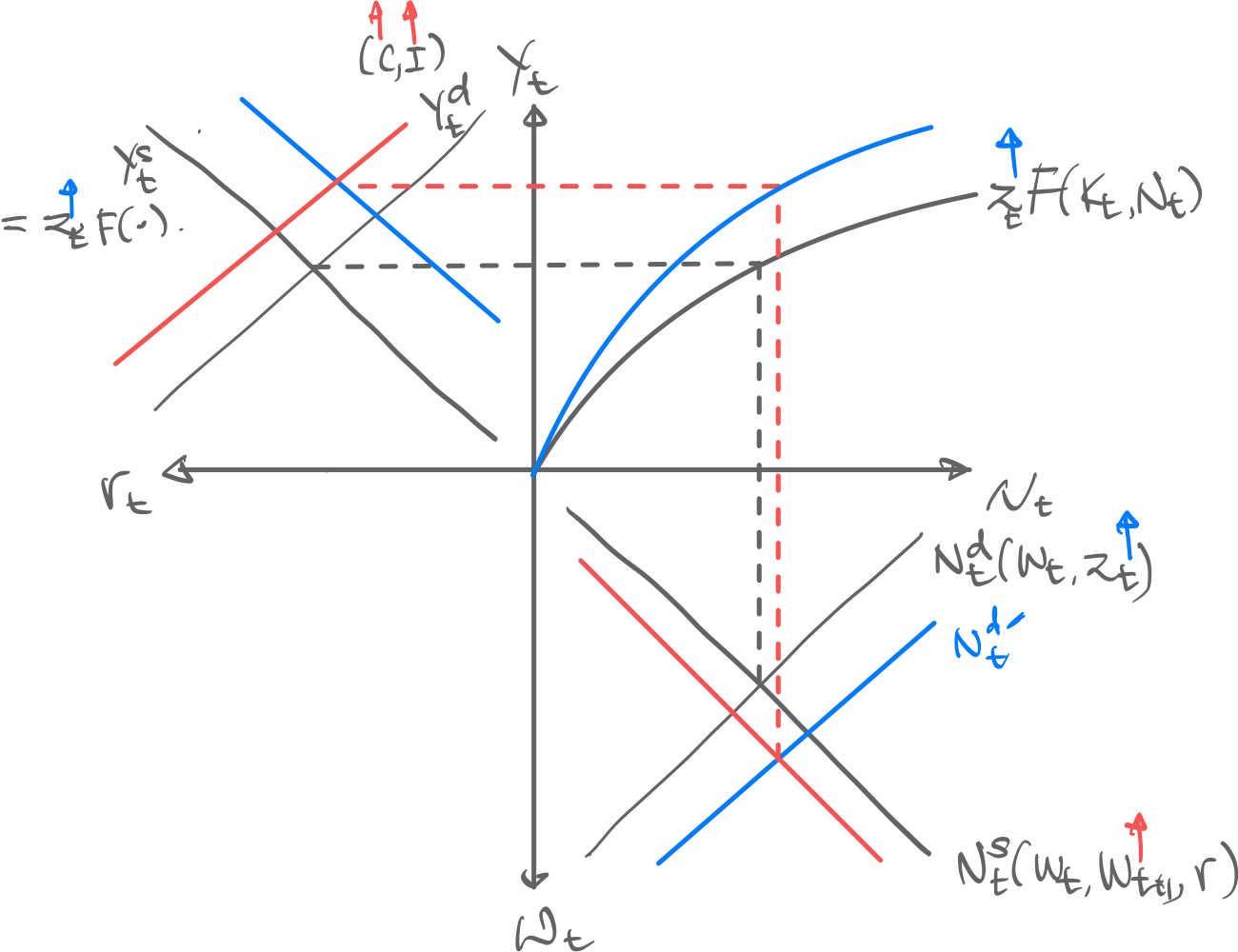

Improving Our General Equilibirum Model

Before proceeding, however, we need to add a few more items into the variables that affect our general equilibrium. From General Equilibirum Functions we have:

- Labor market

- Goods market - - We will now consider a change in (not ) and its effects:

Investment

On via , investment decisions. Expand the optimal investment decision condition:

Observe that for the optimal investment decision, as increases, has to increase to too balance the equation, as is held the same. Also note that also increases Intuition. Firms want to invest in more capital since productivity of capital in the future will increase.

Consumption

On via , current consumption decisions. The firm prices the optimal future wage as:

Profits (which go to HHs eventually) also increase:

Intuition. As lifetime wealth increases, consumption increases too, with the same reasoning as shown here.

Laborx

On . As lifetime wealth increases, consumers reduce their working hours, with the same reasoning as shown here again.

Effects of Current and Future Increase

- Direct Effects ( increases)

- Production function increases

- increases as firms take advantage of more efficiency

- increases as firms produce more

- Secondary Effects ( increases)

- increases as explained above (via )

- decreases as consumers’ lifetime wealth increases

- Equilibirum condition achieved.

- Wages are higher

- Assume direct effects are stronger than indirect effects then

- … interest rates fall

- … employment rises