In Perfect Credit Markets

ass. Financial Markets are perfectly competitive, i.e.:

- they have no market power, and no profits

- interest rates are unaffected by household optimization Q. Intertemporal household optimization problem. We start with the two-period situation with the following budget constraints:

where:

- : disposable income

- : interest rate And solving for we get: lem. Two-period intertemporal household lifetime budget constraint:

thus we get the optimization problem:

we can make this into an unconstrained optimization problem by substituting in the utility function with the budget constraint. Rearrange the NPV lifetime wealth, which we term :

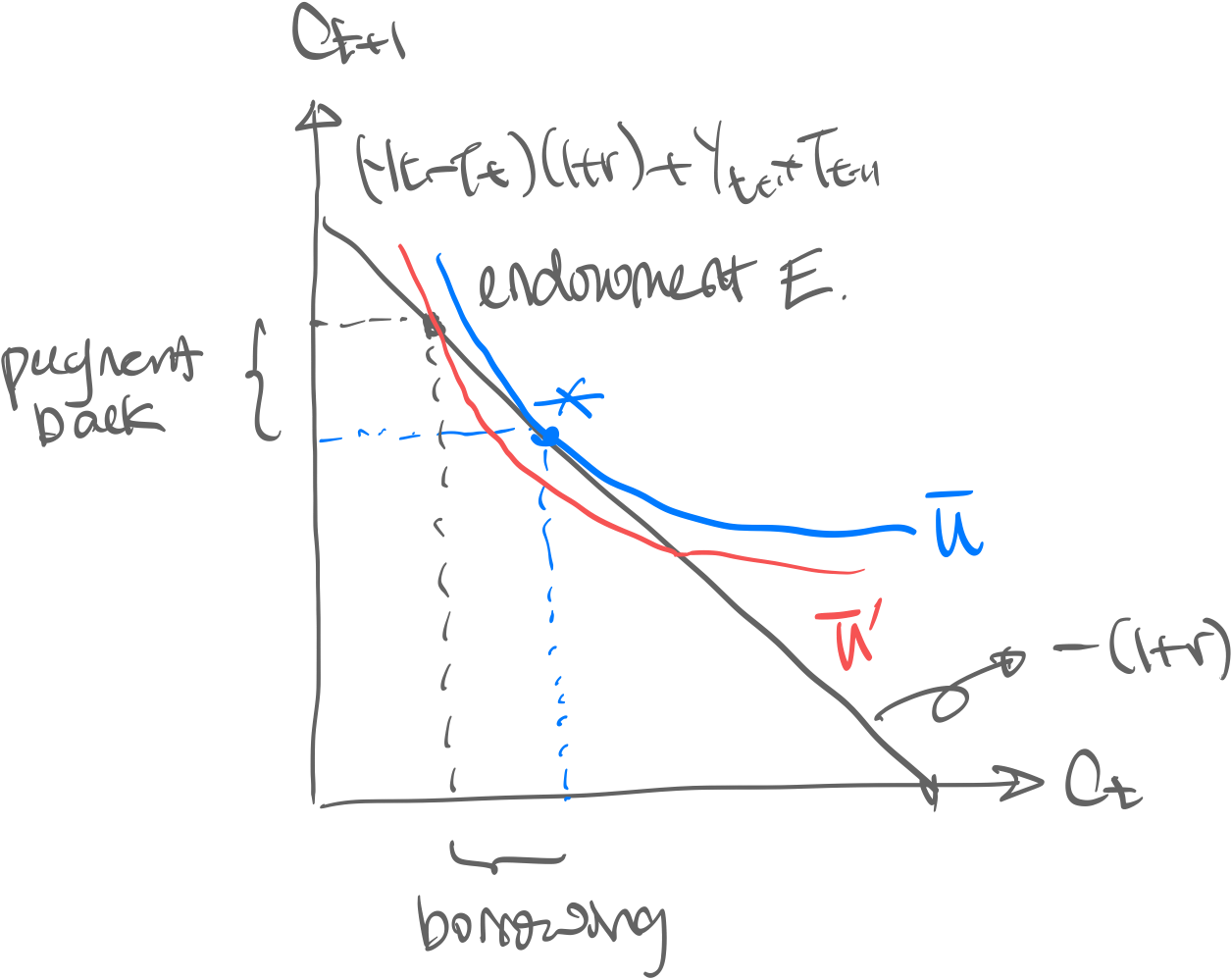

Which is the budget constraint plotted below:

where:

where:

- : consumption endowment. We always start here

- : maximum utility without borrowing/lending (=w/o financial markets)

- : maximum utility with borrowing/lending

- Slope of the budget constraint is as derived from the lifetime budget constraint; simply because this is the rate at which you can trade current and future consumption Intuition. Financial markets allow a household to shift consumption forwards/backwards in time. this is called consumption smoothing. Remark. The household still has convex utility, meaning it has a taste for variety. This means often that households will try to balance current and future consumption Remark. thus at optimal

Taxation Effects

Timing of does not distort interest rates, thus does not affect optimization

In Imperfect Credit Markets

Motivation. In reality credit markets do not follow the assumptions stated above. In reality, we consider risk. thm. Profit function of Banks

where:

- is the interest rate for (businesses/HHs) borrowing investment for consumption

- is the total amount loaned out

- is the interest rate for consumers “lending” to banks

- is the total amount deposited Remark. is also known as the credit spread. ass. From now on, we assume thus:

Modelling risk

A loan amount is a Bernouilli trial with:

- probability of successful repayment → repay

- probability of default → repay

- Expected bank profit for loan is In perfect competition, we have thus:

Thus when we have .

Imperfect Credit Household Optimization

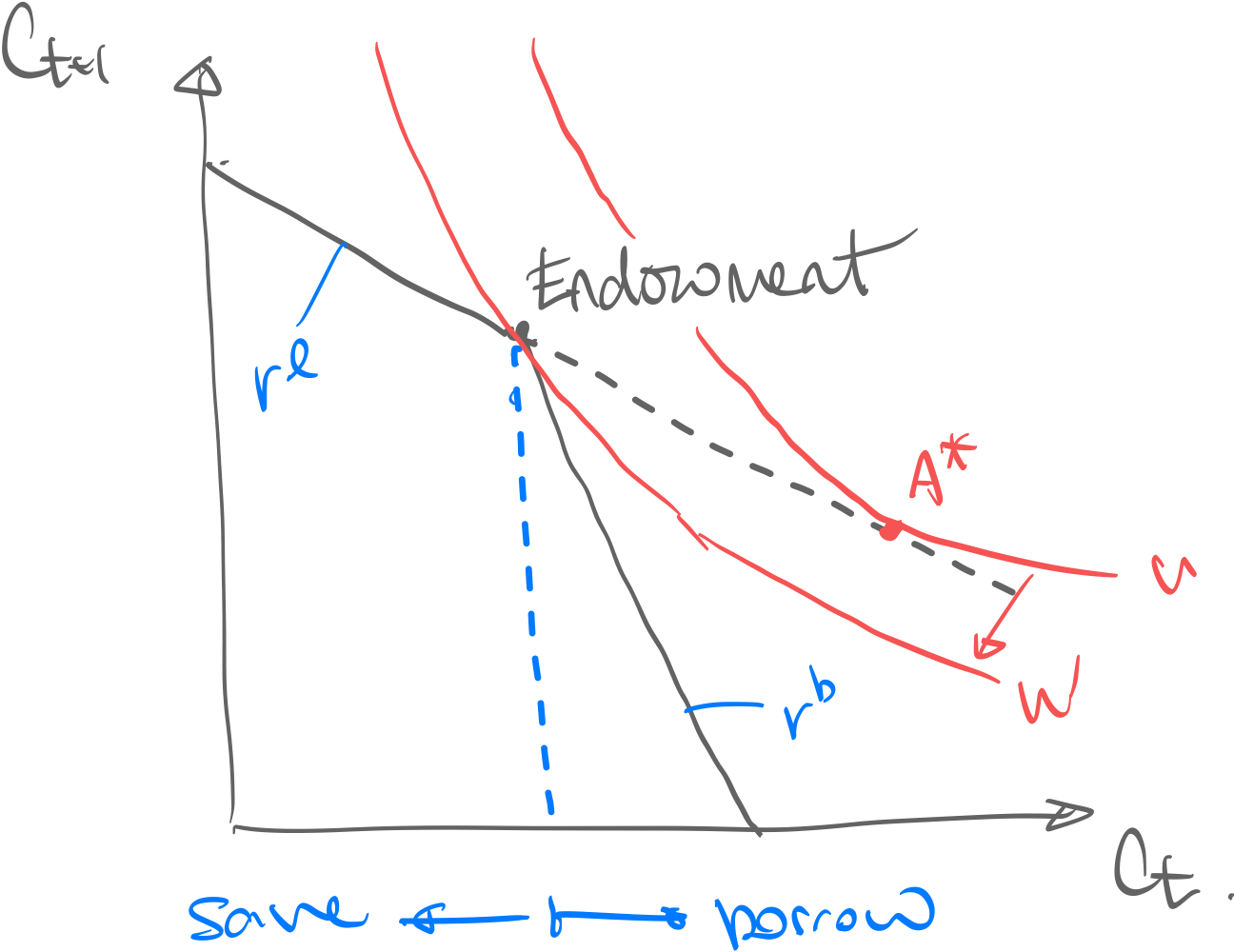

The intertemporal budget constraint is broken into two parts:

Thus:

Drawing only relevant parts from the endowment point :

where:

- due to imperfect markets

- is the potential optimal point if Financial Markets were perfect

Effects of…

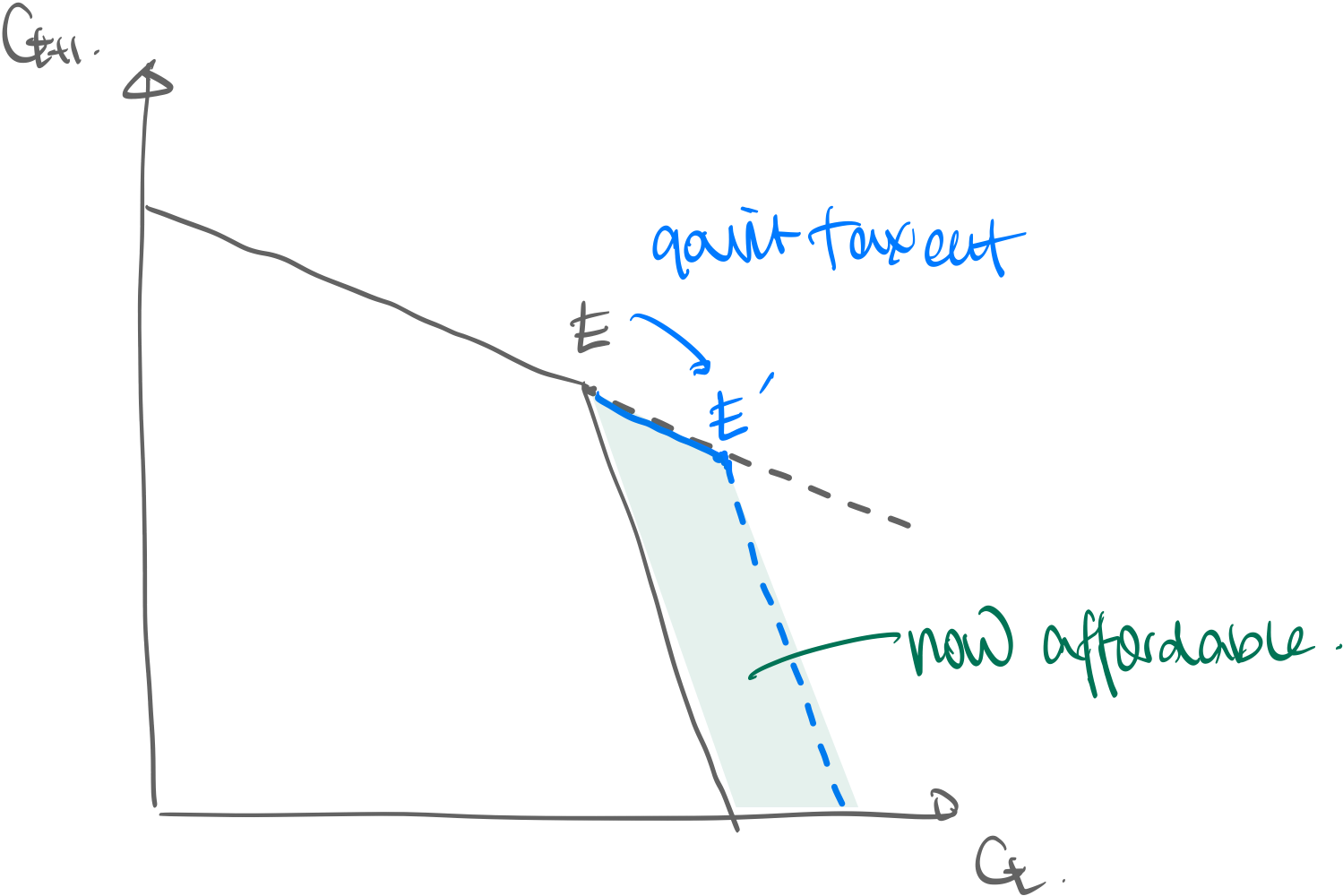

Taxation

Intuition. Government tax cuts are always good, and always better right now, because the government essentially borrows for you at the lower rate :

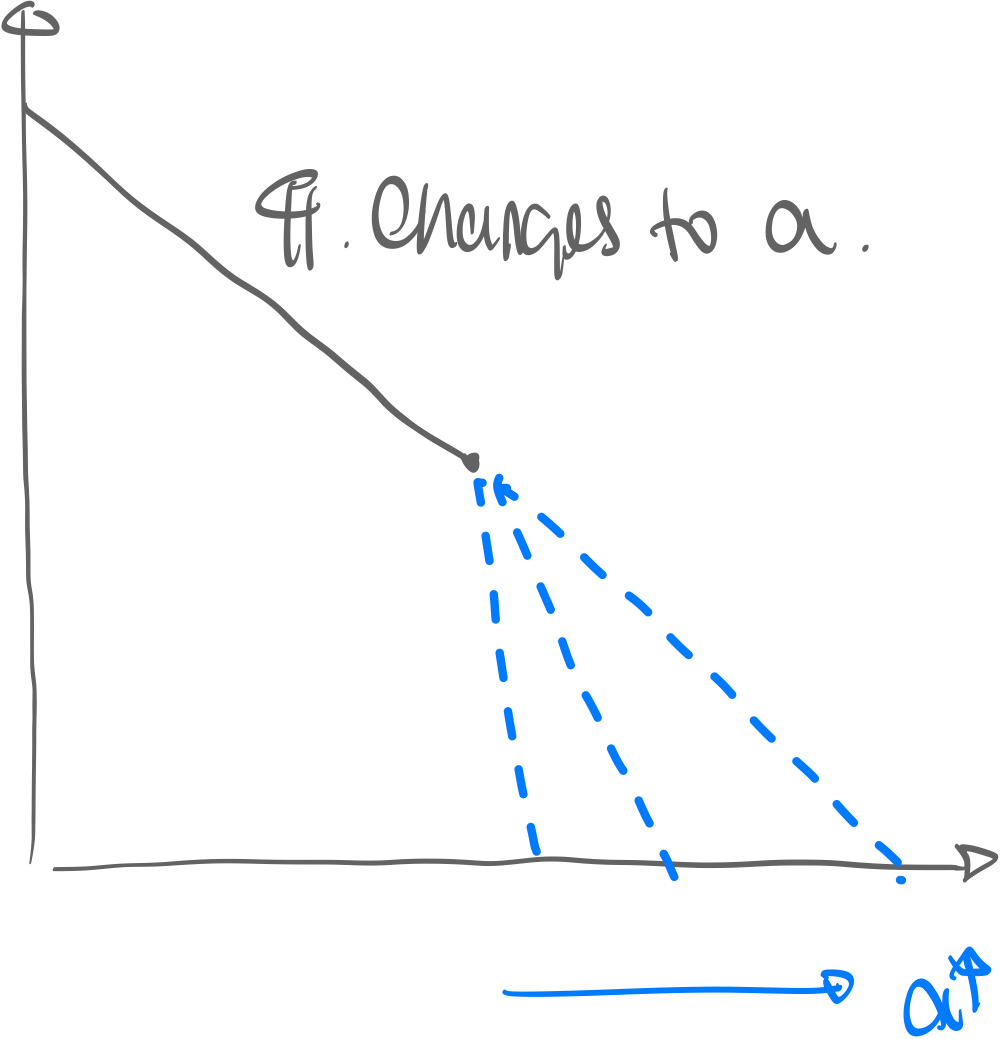

Recession/Market Risks

Intuition. Changes in i.e. default risk will simply change the borrowing rate:

Counterparty Risk and Collateral

Motivation. Banks don’t know if a borrower is credible or not, due to counterparty risk (=Asymmetric Information), banks require a collateral (usually a house) for consumers to borrow. The budget constraint changes thusly: