Market Beta ()

- Intuition. Market Beta measure the correlation between security with market . It therefore is proportional to market risk (if is big, market volatility triggers security volatility).

- Consider:

- Security with

- Market

- & Market Beta measures the degree to which the security price correlates with the market price

- Market beta is a coefficient of regression, derived from past data

- Market’s market beta is .

- Definition:

- or equivalently ← ”CAPM Model”

- Under assumptions is positive definite, are linearly independent and

- : security return is opposite of market

- : security is uncorrelated to market

- : security return moves same as market, but fluctuates less (defensive)

- : security return moves same as market, but fluctuates more (aggressive)

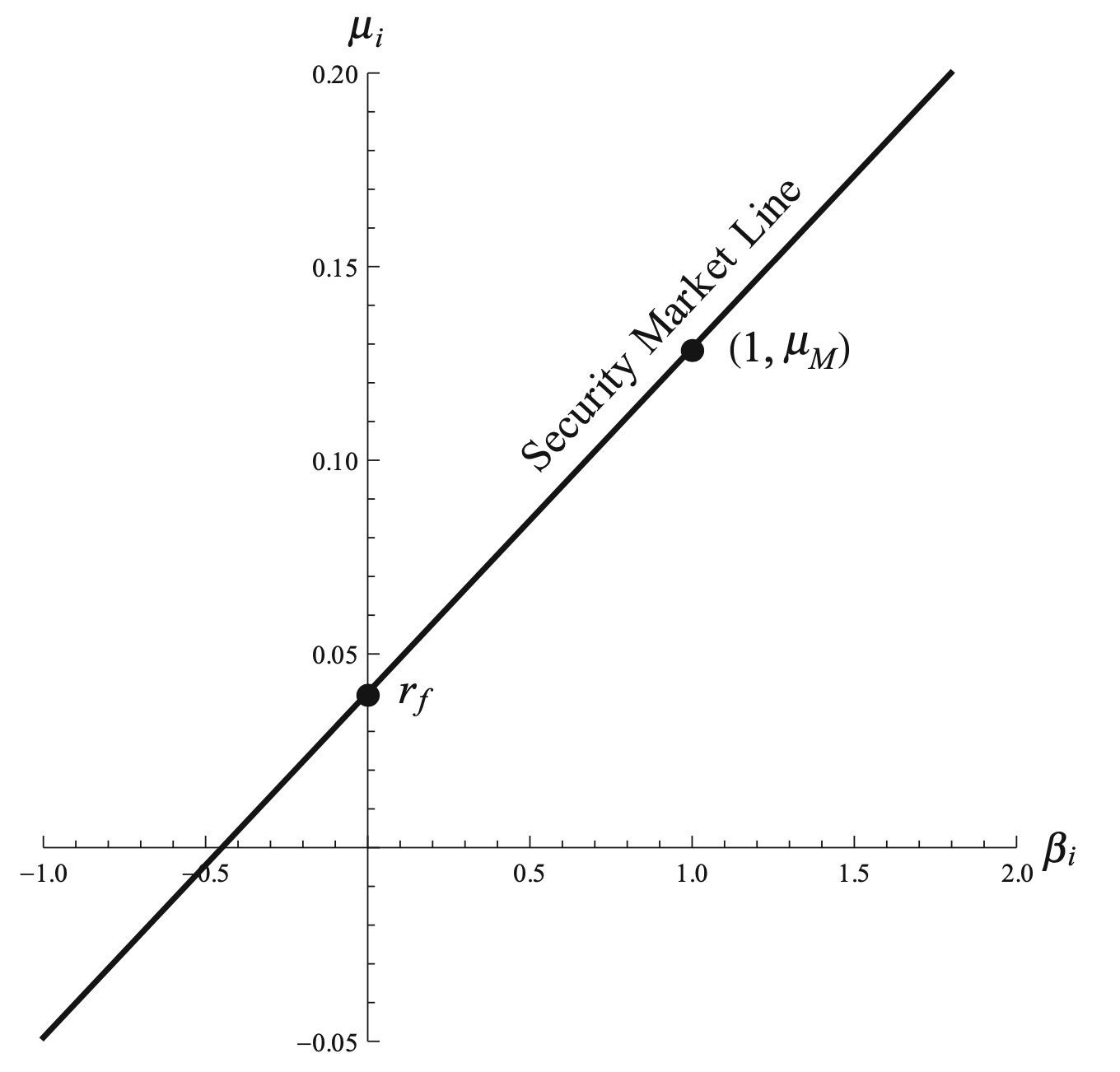

Security Market Line

Plotting with return vs market beta: