Annuities are…

- Money you borrowed: mortgages, etc. ⇒ pay regularly to pay off large amount

- Money you lent: social security credit, etc. ⇒ give large money, get regular payments later

Amortization is the same thing but from a different perspective ⇒ You’re spreading a one-time cost into multiple years. Formulae are same if the recurring payments are of the same amount.

Types of Annuities

- Ordinary Annuity: payment occurs at the end of each period

- Simple Ordinary Annuity:

Formulae for Constant Payment

- : Term; time from first payment to last payment (in years)

- : Present value of annuity of terms.

- : Total payment accrued after periods (not a present value!)

- for formula simplification

- Preset value of annuity (=) formula. (see below for more)

- (i.e. the principal loan amount, mortgage loan amount, etc.)

- Payment accrued after all periods (= =Future value of annuity after all payments made) (Demonstration, use geometric sum formula)

- Simplified formula of PV using 1. and 2.

- Remaining balance after periods (=)

Portion of the -th payment that goes to… Principal

- Total Principal ⇒

Interest

- Every period, interest is fully paid.

- Interest is applied to the remaining balance (not to be confused with )

- Total Interest ⇒

⇒ Thus the total payment:

- Consider -periodic compounding (= times every year)

- Cost of Loan: ignoring the time value of money, sum of all interest payments

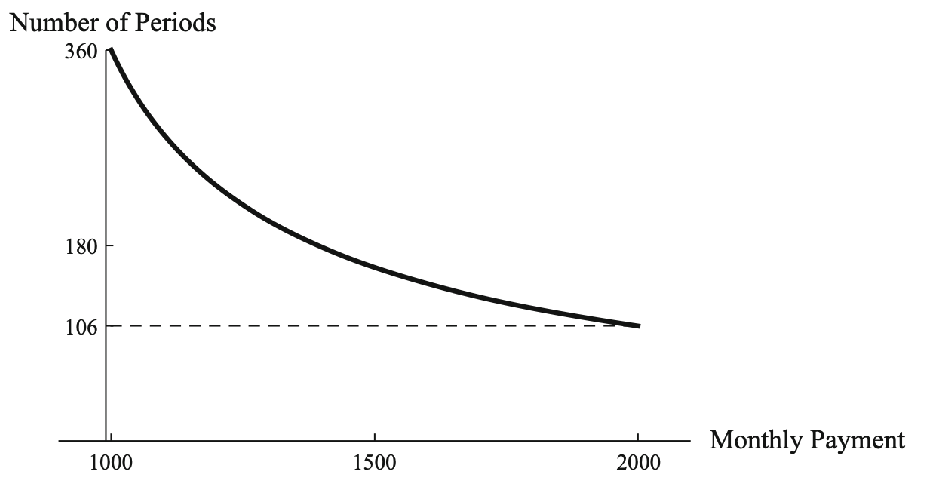

- As montly payment increases, number of payment periods decays exponentially.

Formulae for Variable Interest Rates

Variables are same as above, except:

- : payment after period

- : interest rate during period

- Present value of annuity ()