def. Cashflow Statement. A table showing the firm’s cash in and out.

- D&A addback: you’ve already payed for the factory (un-smearing the cost)

- CapEx & Salvage: money you’re paying for the capital [=capital expenditure], and cash from selling the capital

- Change in Working Capital: Recieveables & Payables

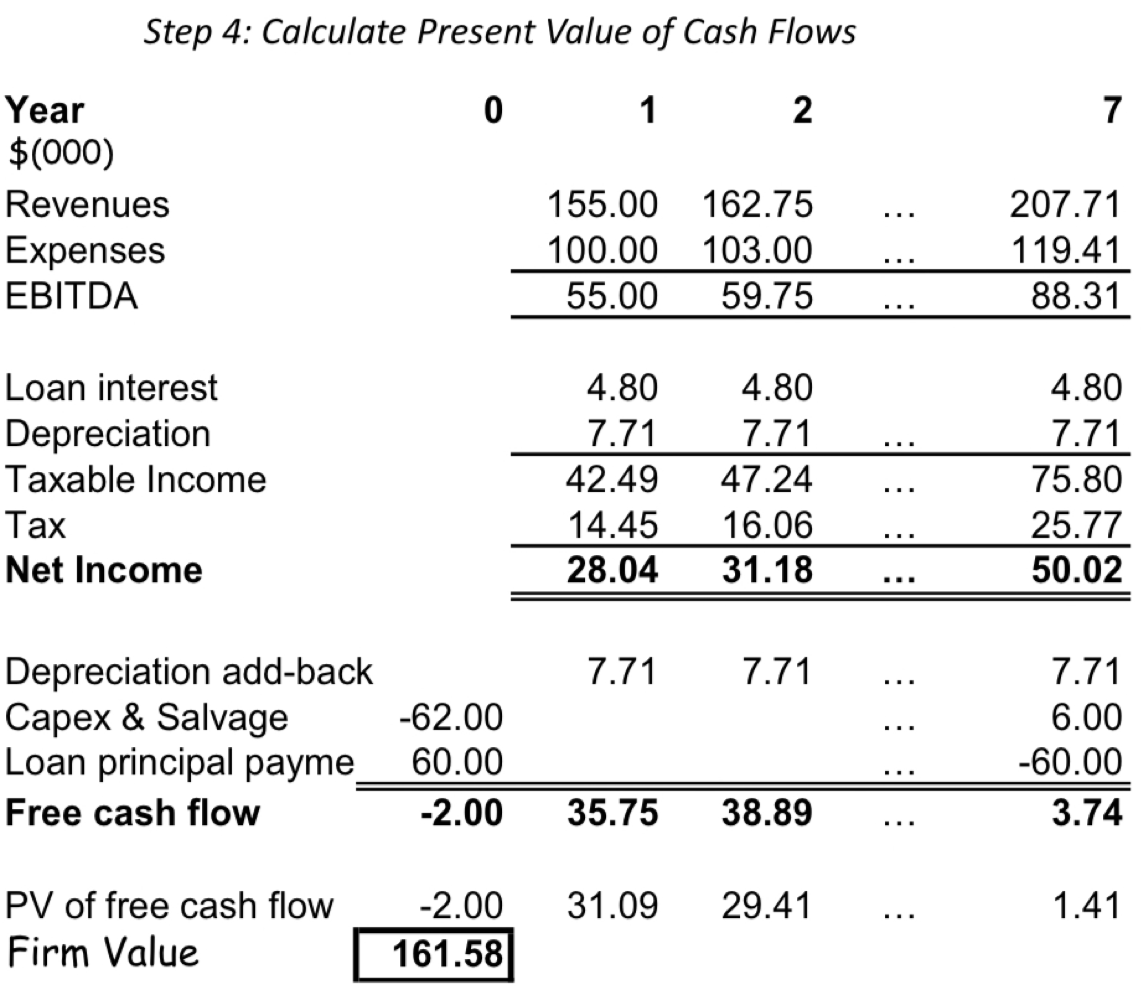

Example. The process of valuing a firm using Free Cash Flows:

- Calculate Net Income (excl. interest, tax, etc.) from Income Statement

- Future cash flows are just guesses

- Calculate Free Cashflow (w. CapEx & Salvage)

- Discount future cash flows to get Net Present Value = Firm Value Discount parameter is usually obtained from investments with similar risk profiles, or the WACC formula.

Internal Rate of Return (IRR). It’s another type of interest rate.

- Too much cash isn’t a good thing, because it means they’re not getting high return on capital.