Consumer Surplus

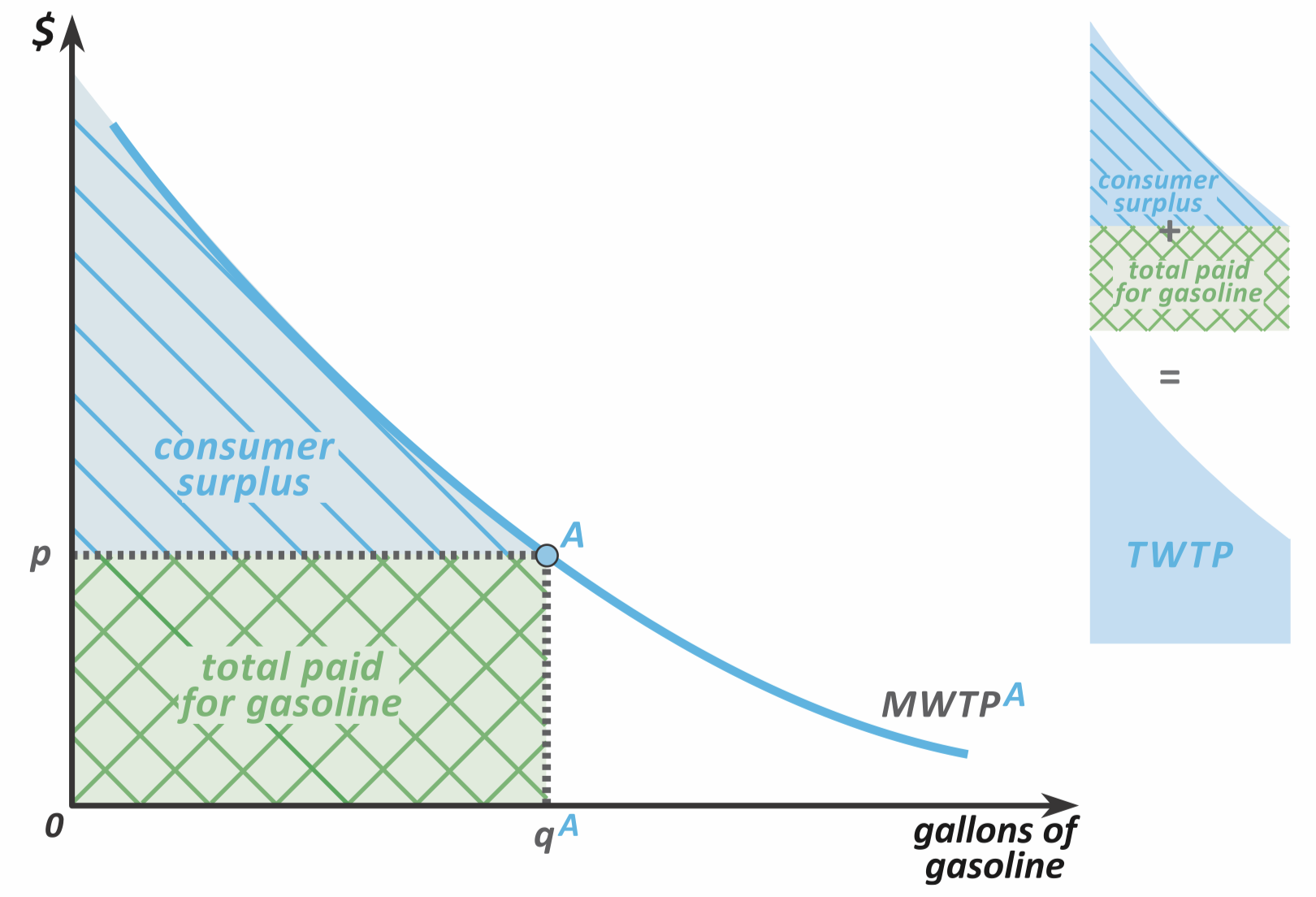

Marginal Willingness to Pay Curve leads naturally to the concept of consumer surplus. Follow the following line of logic:

- The area under the MWTP curve is the Total Willingness to Pay (TWTP)—the amount the consumer was willing to pay to get amount of goods.

- Since they didn’t have to actually pay that amount (they only paid ), they’re better off.

- The quantitative amount that they’re better off is the Consumer Surplus

Deadweight Loss due to Taxation, Analyzed with MWTP Curves

Consier a distortionary tax on housing prices, per square feet. The blue line shows the price per sqft of housing. The red line shows the post-tax budget line, and is the optimal point.

- → What if instead the government took away a lump sum instead of a distortionary tax? The amount taken away is and the green line shows the new budget. In this hypothetical, ideal case, the optimal is .

- → In this case, the distortionary tax collected for bundle is vertial distance . As , the vertical distance shows the Deadweight Loss for the taxation. (The lump sum was better.)

Alternatively, consider graphing the MWTP for utility , using points .

- → With the distortionary tax—optimal bundle: , . Govn’t revenue is

- → With the lump sum tax—optimal bundle: ,

How come the consumer has more surplus as in the bottom graph? Aren’t they indifferent in MWTP?

- → The consumer instead lost the collected lump sum tax, ;

- → ∴