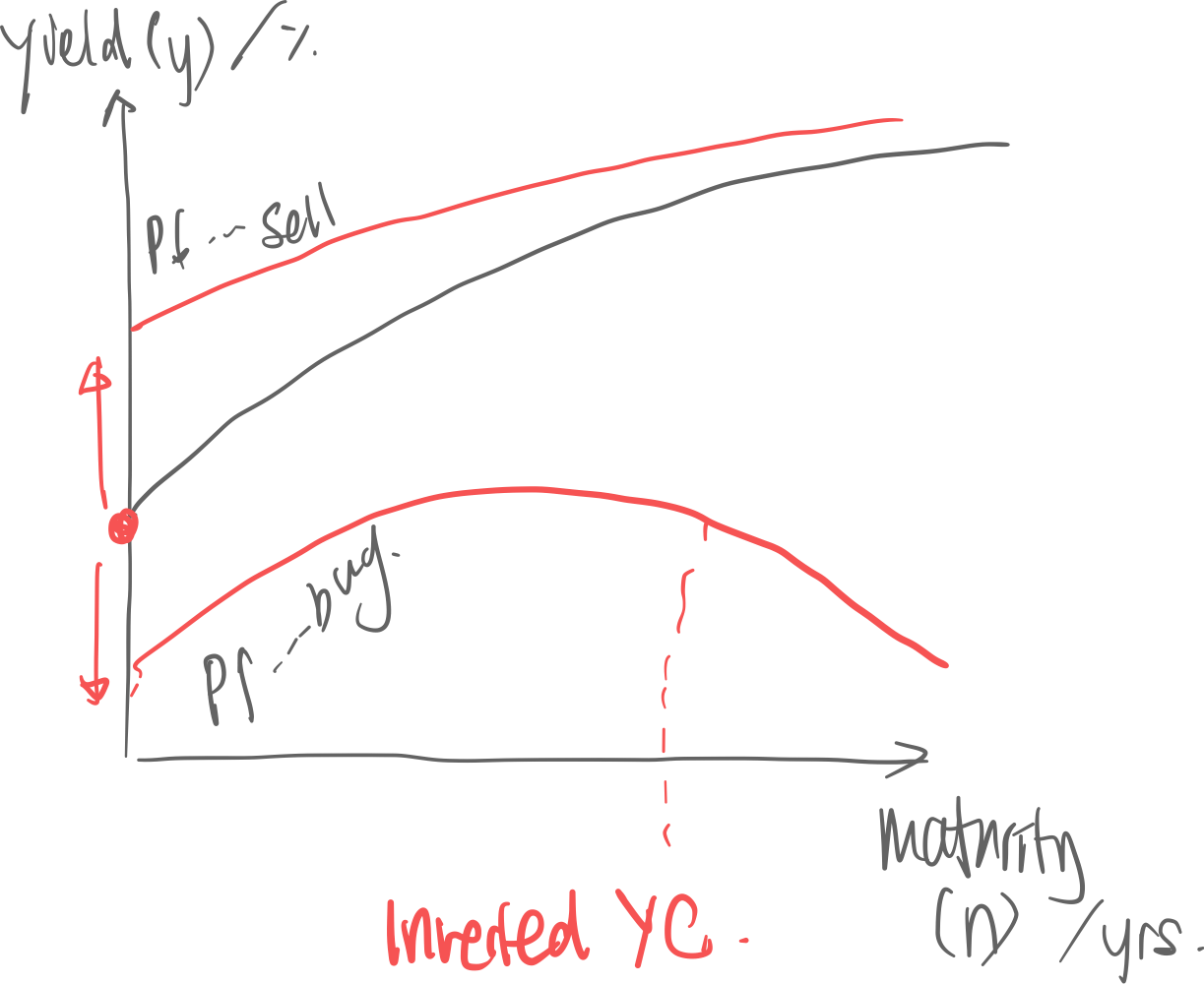

Relationship between yield and maturity of a bond.

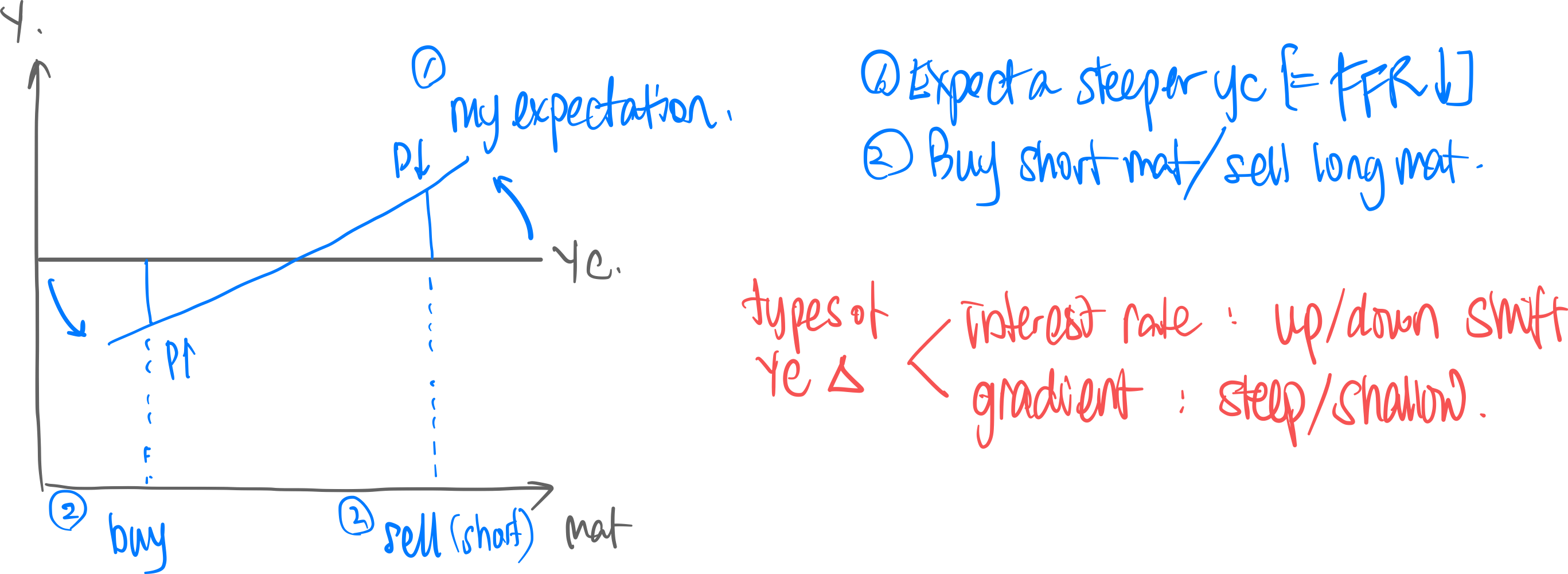

Interest Rate Changes

The government can change the federal funds rate, which influences the y-intercept of the yield curve:

- Inflation ⇒ interest rate ↑ ⇒ firm borrowing ↓ ⇒ investment ↓

- Recession ⇒ interest rate ↑ ⇒ firm borrowing ↑ ⇒ investment ↑

An inverted yield curve occurs as the bond market:

expects a recession ⇒ expects the government to increase the interest rate ⇒ long-maturity bonds are more appealing.

Making Money off Bonds

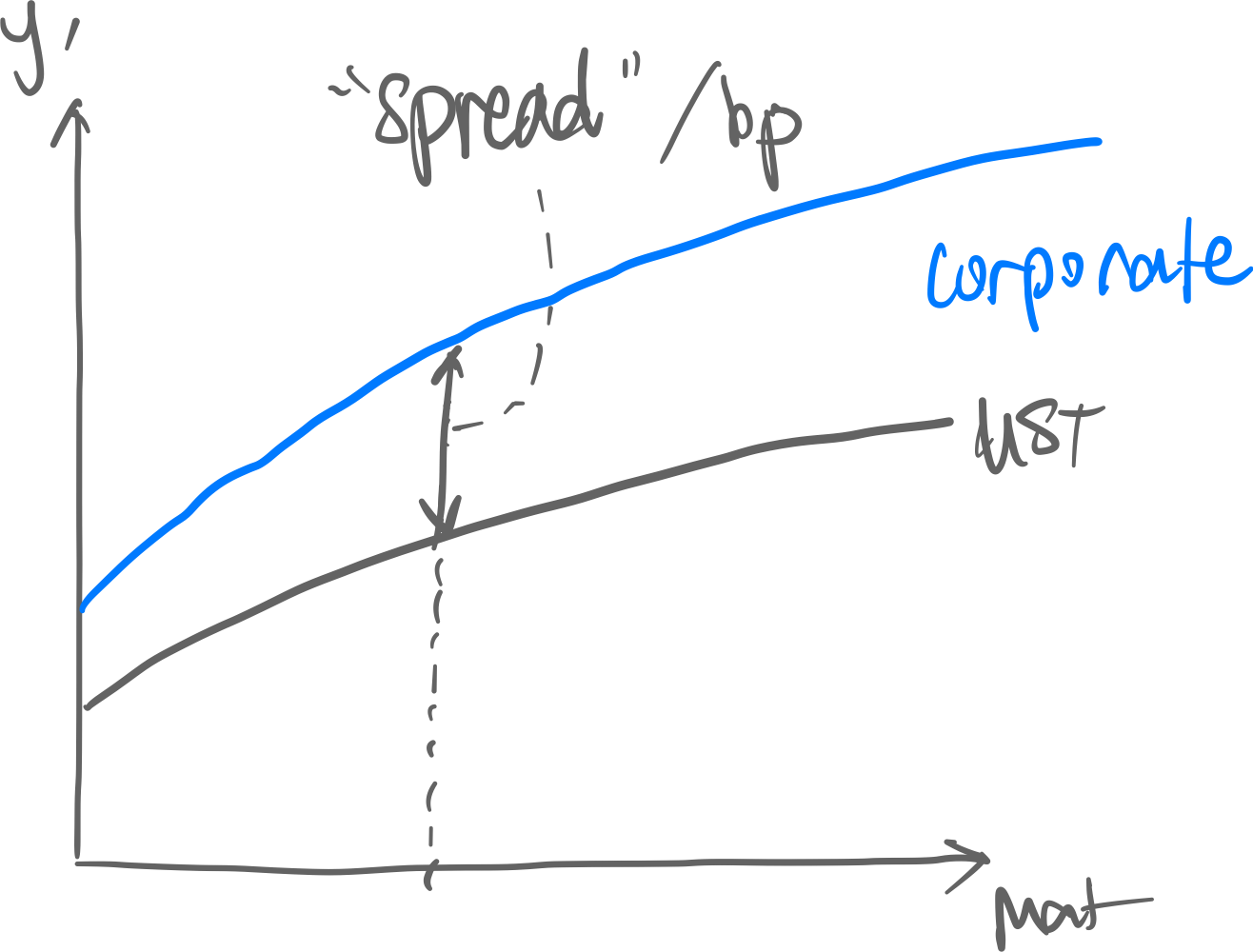

Credit Curves

- Government bonds have the highest credit rating

- When comparing other types of bonds (e.g. corporate bonds), any bond with the same maturity has a higher yield than government bonds.

- Spread is the difference in yield between it and government bonds.

- Spread 1/Credit maturity, and is related to industry

-20240119160105122.png)