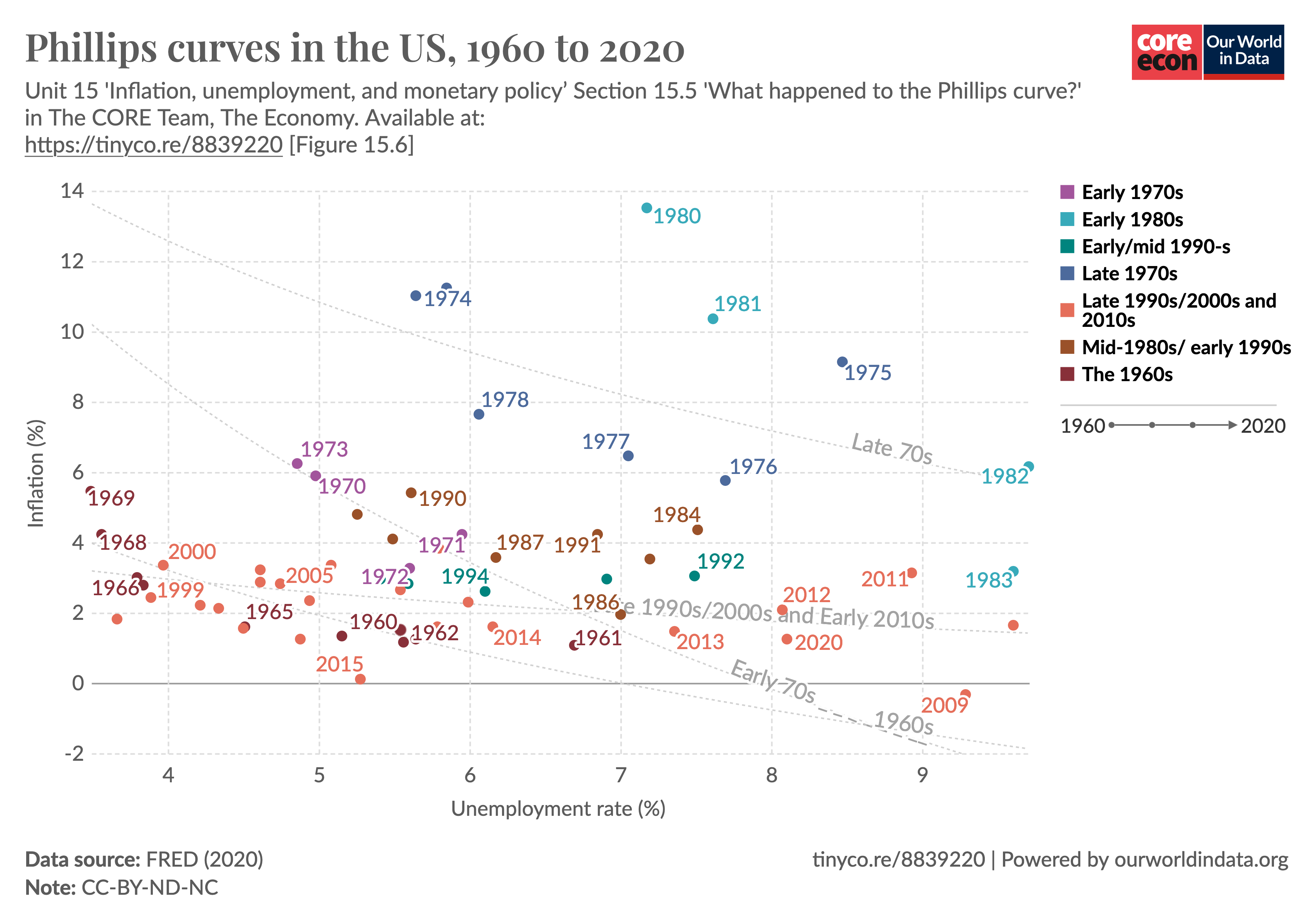

Motivation. There is this interesting data that shows negative correlation between unemployment and inflation. This shows a few things:

- Monetary Neutrality doesn’t seem to hold in the real world, because nominal prices are correlated with real variables

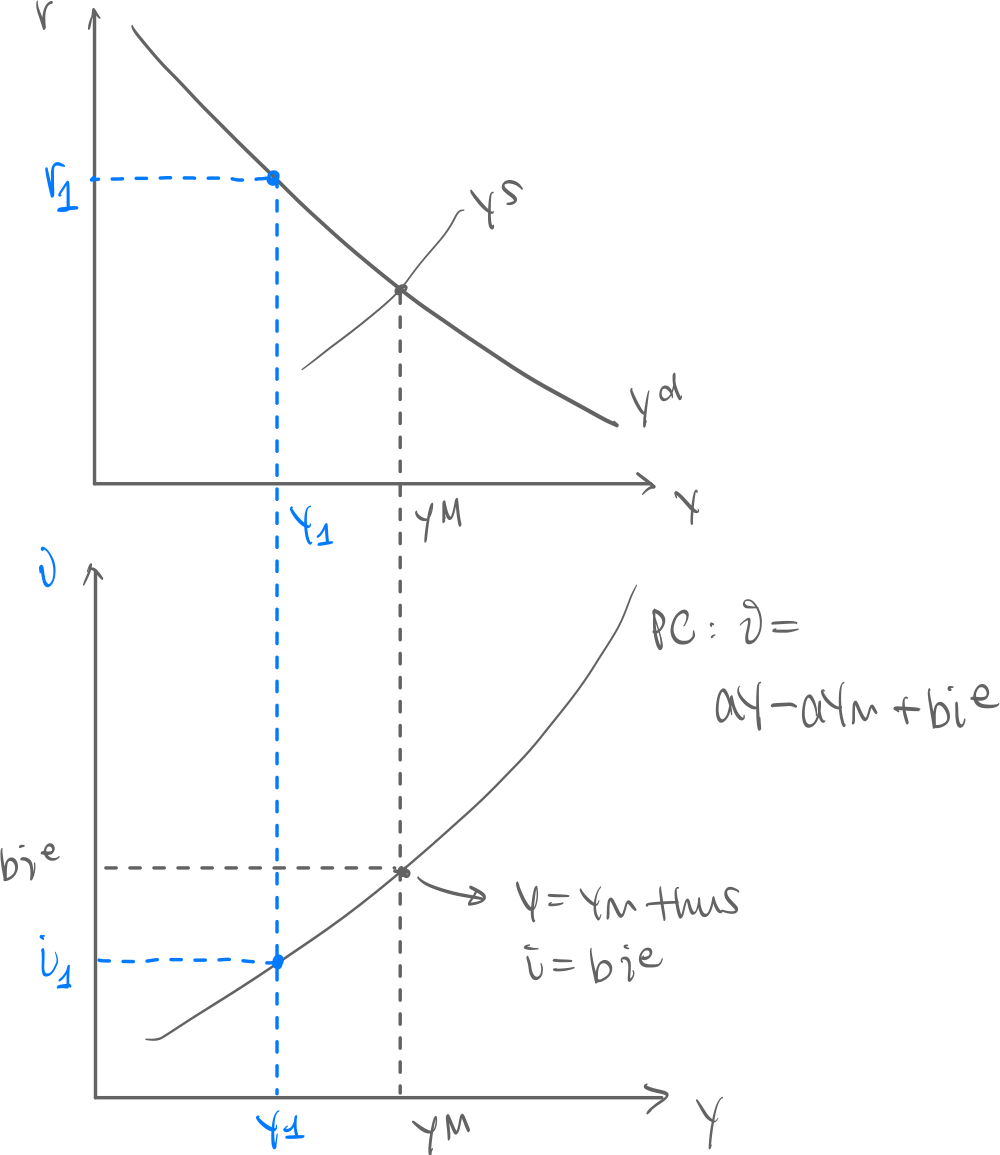

- We need to model this! Since unemployment is a counter-cyclical variable and it’s easier to have a positive correlation equation, we instead consider GDP vs Inflation:

where:

- is the inflation, or rate of price change

- is the expected inflation. This can be whatever, but we assume for now it is constant.

- are coefficients. We can assume and .

- , as shown in New Keynesian Business Cycles Model, is the output gap Thus:

- The first term shows sensitivity of inflation to the output. This is because the higher the output, the more firms increase prices

- The second term shows the sensitivity of inflation to inflation expectation. This is because as firms expect prices to go higher in the future, they also increase prices now to match.