Assumptions

- ass. Investments are equal to savings, i.e. all savings are invested.

- ass.

Intertemporal Utility Maximization

ass. Households perform intertemporal utility maximization. Similar to Utility Maximization but according to the following general form of intertemporal utility maximization:

The equality is the intertemporal budget constraint that holds from . Limit the time horizon to just two periods, and . Then:

- Capital stock is initially

- No savings at second (=last) period Then the two constraints:

- Equating for we get:

This is the intertemporal budget constraint. Now solving for the maximization problem for the above Cobb-Douglas Utility function to get Unconstrained Maximization:

we get the first order condition (by optimizing the log of the utility function and getting first derivative):

where

Capital Accumulation

ass. Law of Motion (Capital) Capital stock is acculated and depreciated via the following equation:

Then consider where is the savings rate. Then

thm. Law of Motion (Capital, intensive) i.e. per person:

- i.e. capital intensity, in

- i.e. population growth rate

- is the individual production function, i.e. per worker ()

- , investment (=saving) in intensive form

- works because of assumption of constant returns to scale:

Implications

corr. Capital change can be simply caldualted:

- Capital accumulation cannot explain per capital GDP growth

- …due to diminishing in

- Explains why per capita GDP converges to a certain point (intersection point in right graph)

- Expalins why total GDP grows as population increases, but also that population growth does not cause per capital GDP growth

Steady State Capital

We consider the steady state point, the intersection point in the right graph. We assume:

- i.e. capital growth rate

- i.e. Cobb-Douglas production function

At steady state . Thus:

Reformulation with Productivie Hours of Labor

let

- the growth rate of .

- disembodied intensive capital i.e. “body-hours,” i.e. when productivity is disembodied.

- This also implies We have thm. Law of motion for disembodied capital:

At steady state i.e. and we get:

Dynamics

Various Growth Rates

Observe first that if can reach a steady state, then growth at the steady state is also zero:

Denote growth rates:

- , population grwoth

- , productivity growth

- , as we showed. Example.

\ln(\tilde{y})=0.

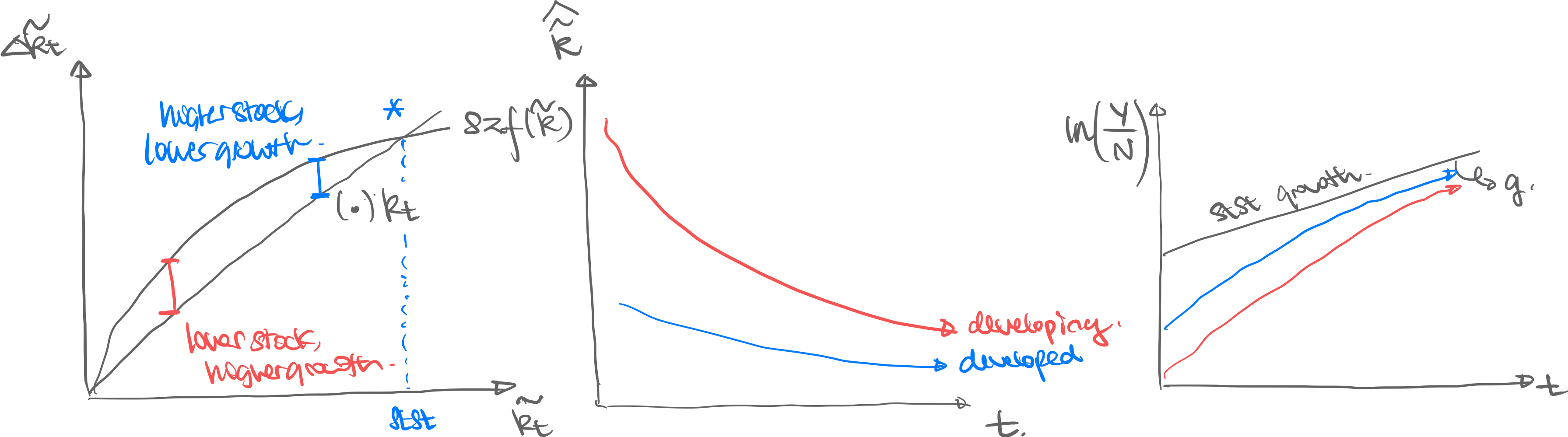

Convergence & Endogenous Growth

Observe.

- Red is developing, blue is developed nation.

- Reason for convergence is dinimininshing marginal product of capital

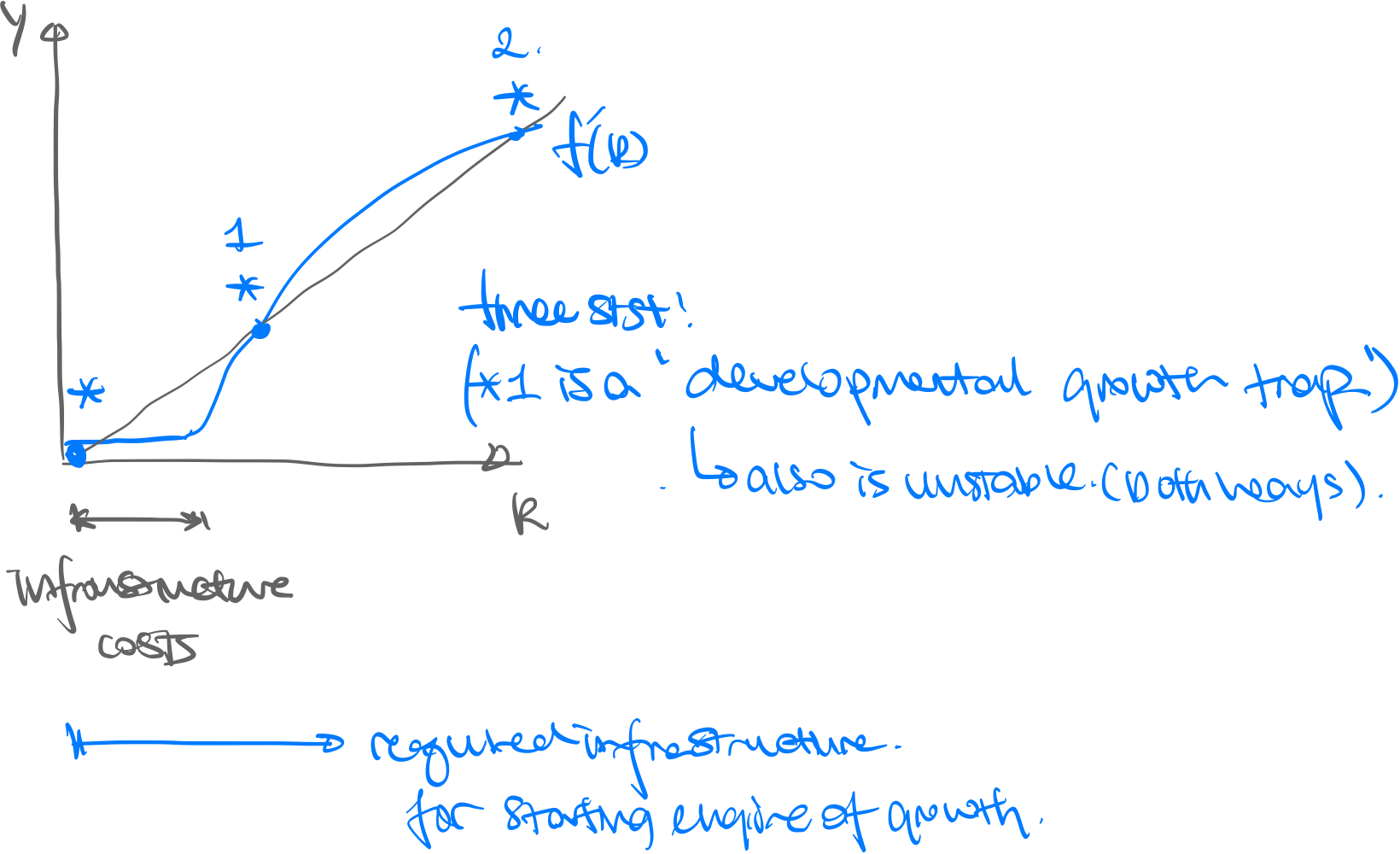

Differently-shaped Production Functions