An option is a contract that gives the holder the right to exercise the option (=buy/sell a stock) at the strike price at or before the strike date.

- It is a type of Derivative

- The person who gives out the option contract is the writer.

- The person who gets the option contract is the holder.

Types of Options

- Exercise timing

- American option: anytime on or before the strike date.

- European option: at the strike date only.

- Exercise type

- Call option: you hold the right to buy the stock at the strike price.

- Put option: you hold the right to sell the stock at the strike price.

Definitions

- : price of underlying asset, at time

- : price of a call option, at time

- : price of a put option, at time

- : strike price of a call or put option

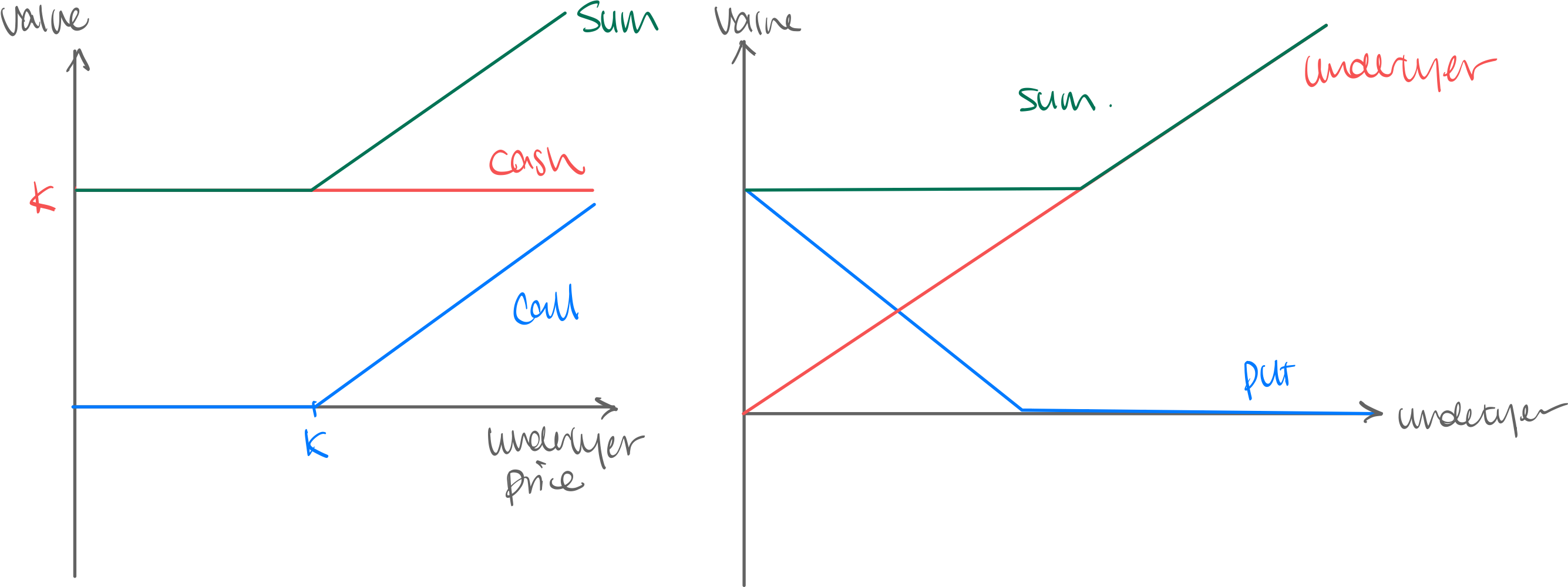

Intuition. (Payoff Diagram for Options)

-20240304134608116.png)

Call Option

Assume continuous compounding at rate between time period . Assume No-Arbitrage.

- Payoff:

- is when the stock price as decreased, so you don’t decide to sell.

- according to the law of one price, must equal to

- Profit:

- First term is the payoff

- Second term is because you borrowed money at the risk-free rate to buy the call option.

- We don’t know what is yet…see Binomial Option Pricing Model

thm. Put-Call Parity. let call option entered at time and put at time . Then

Intuition. You can always use a stock plus a put option to simulate an equivalent call option, and v.v.

Proof Outline. let long call, have units of cash. Let long put, have units of underlying stock. At time they will have equivalent value, thus at time their value must be same by LOP.

Proof Outline. let long call, have units of cash. Let long put, have units of underlying stock. At time they will have equivalent value, thus at time their value must be same by LOP.

thm. Put-Call-Forward Relation.

- Forward entered at and ends at , with strike price

- are call and put entered at time , with strike price

Proof Outline. -20240304140944336.png)

Various Portfolios that Can Be Constructed from Options

def. Moneyness of Option. A call option’s moneyness at time is:

- If : call is in (=on) the money

- If : Call is at the money

- If : Call is out of the money, i.e. worthless.

| Strategy | When you predict… | Profit Diagrams (Not Payoff) |

|---|---|---|

| Straddle | Underlying will move up/down a little | -20240304142227105.png) |

| Strangle | Underlying will move up/down a lot | -20240304142314305.png) |

| Bull/Bear Spread | Underlying will go up (bull) / down (bear) | -20240304142325699.png) |

| Butterfly Spread | Underlying will not move much (long) / move a lot (short) | -20240304142349350.png) |