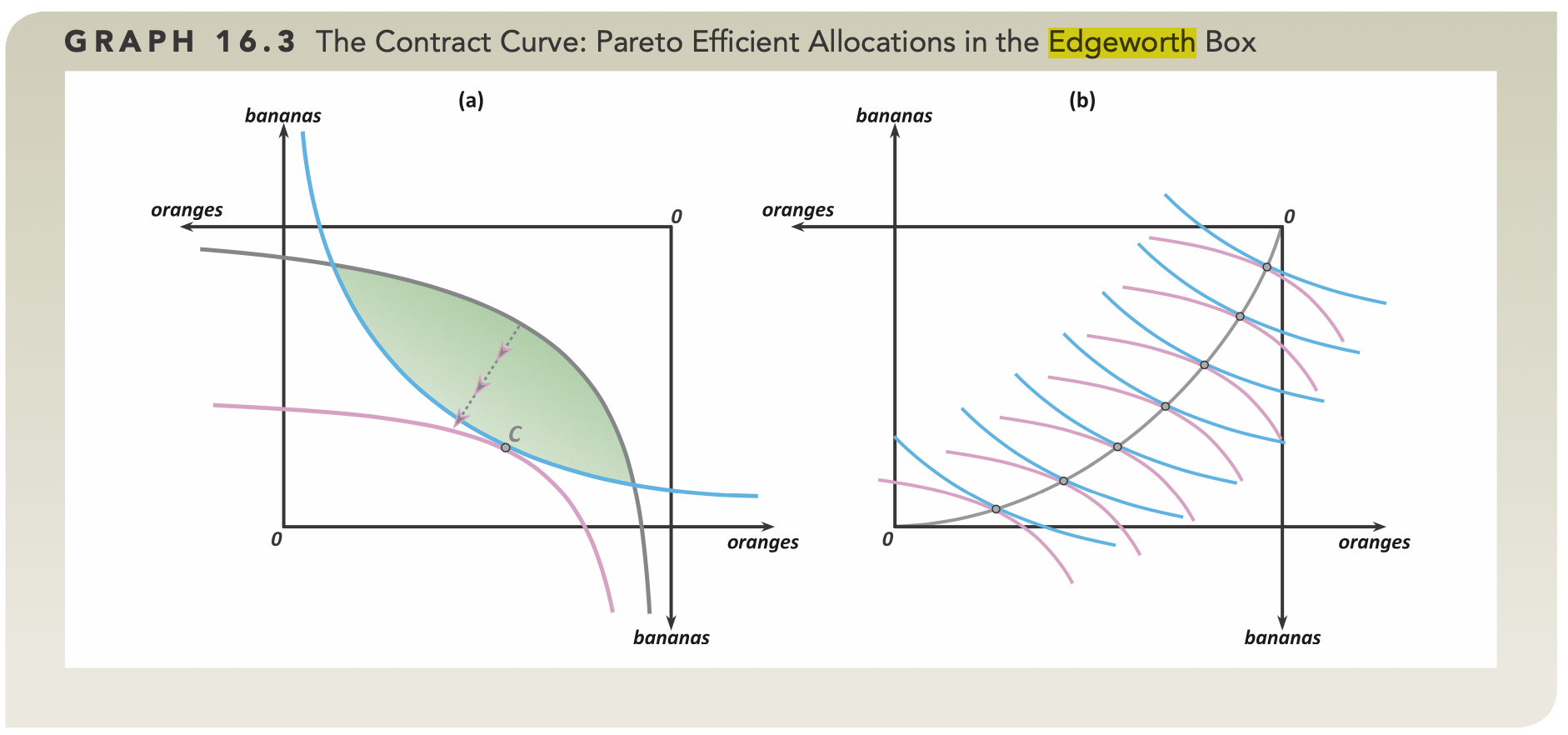

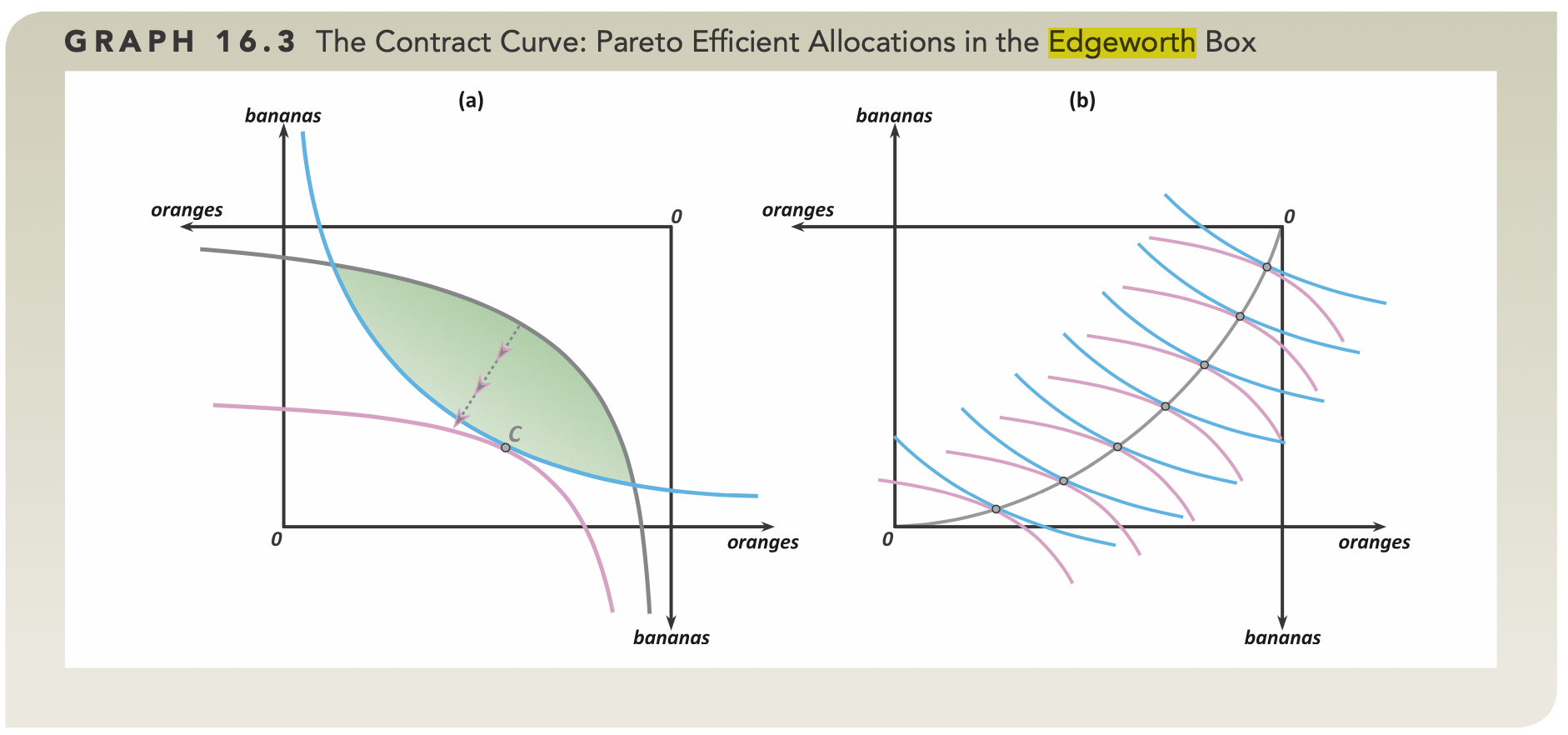

- Contract Curve is the set of pareto efficient points in the edgeworth box.

- Example. The black curve in (b) is the contract curve.

- The gradient of the two curves must be equal in every point of the contract curve.

- The Core is the set of Pareto efficient allocations that make both parties better off than their endowments. (The highlighted section inside the green is the core.)

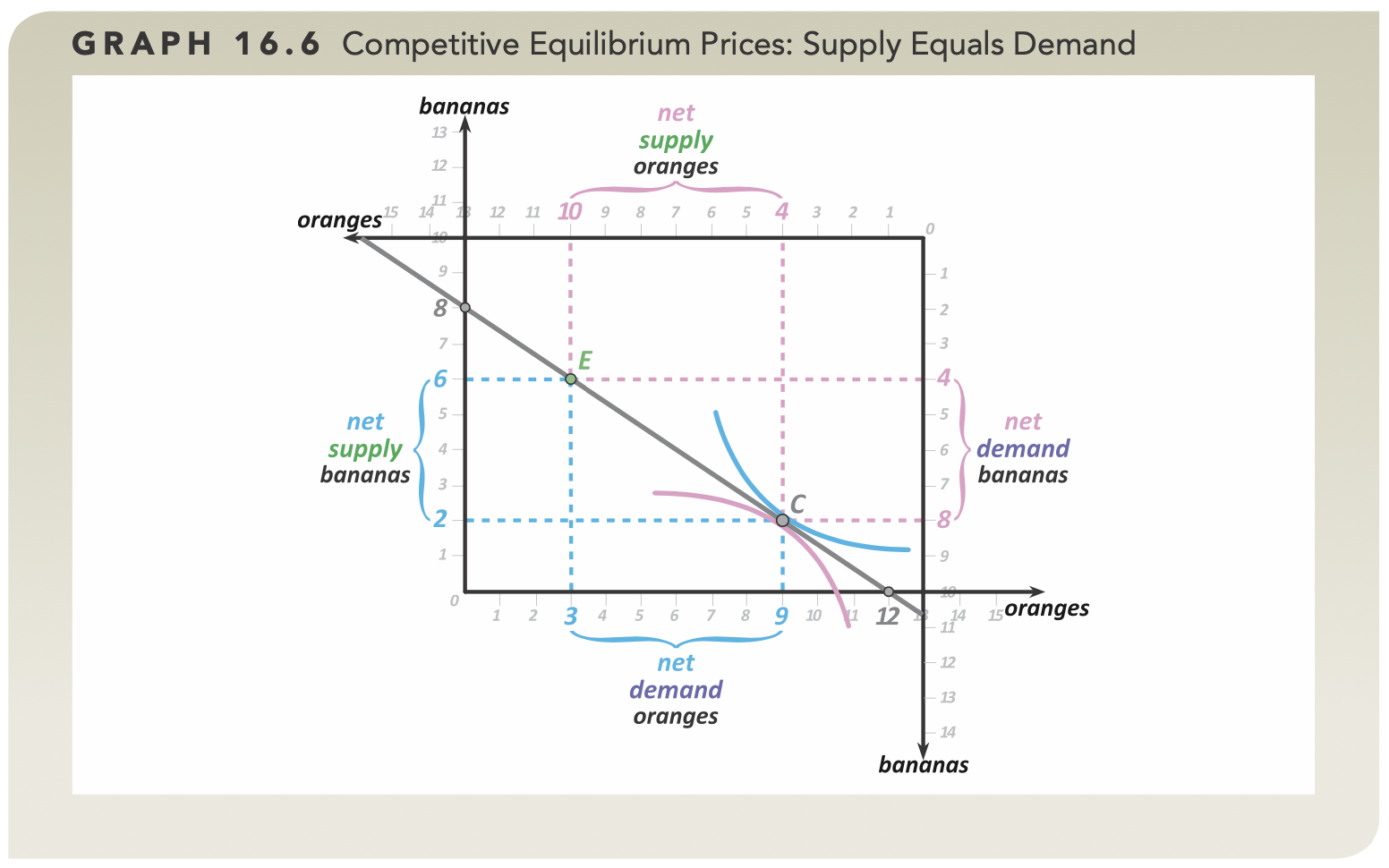

- Equilibrium is when the exchange rate of goods (i.e. the price ratio) is set in such a way that trade occurs and there is market clearance (i.e. Qdemand=Qsupply).

- It must be pareto efficient.

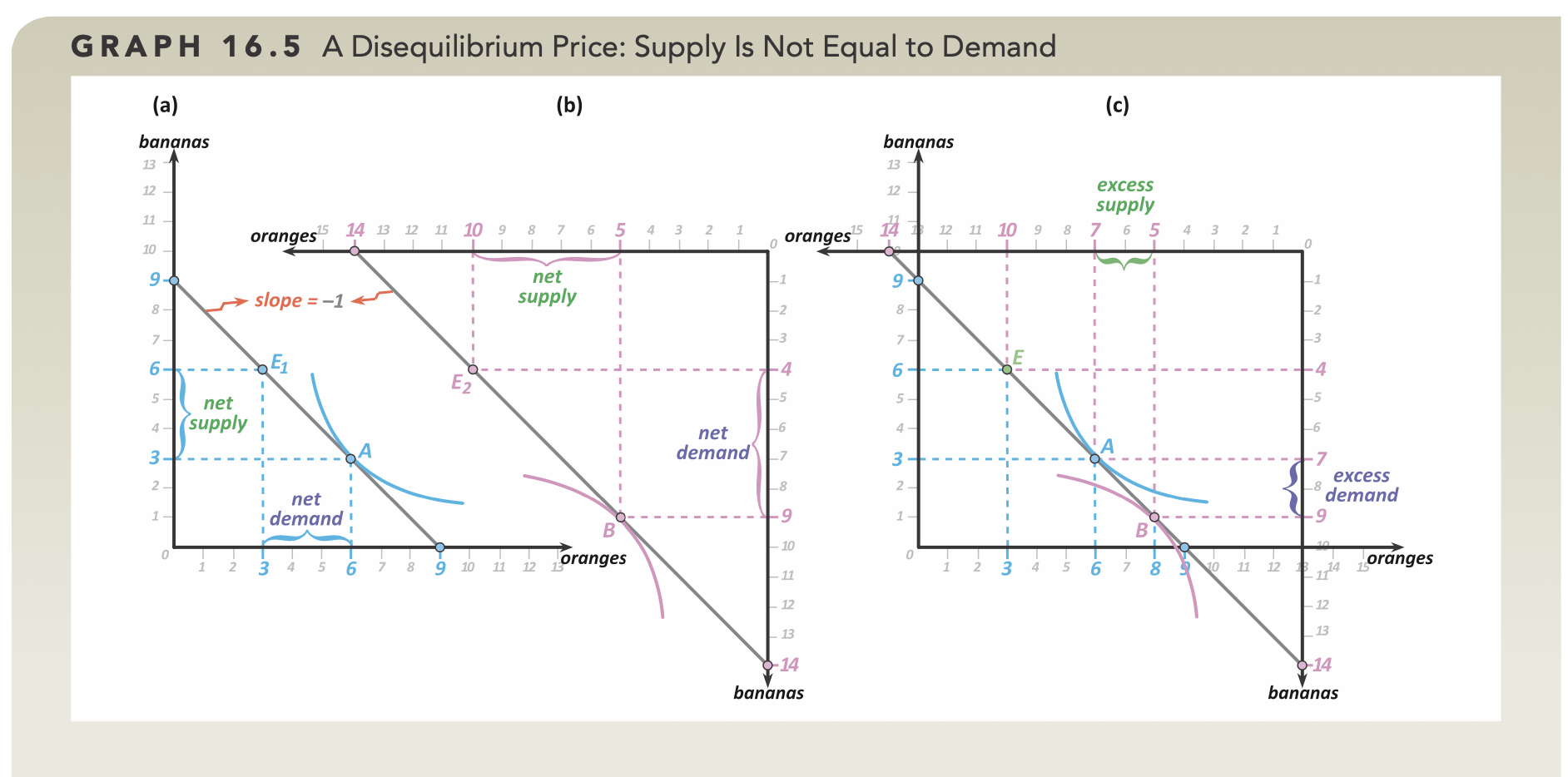

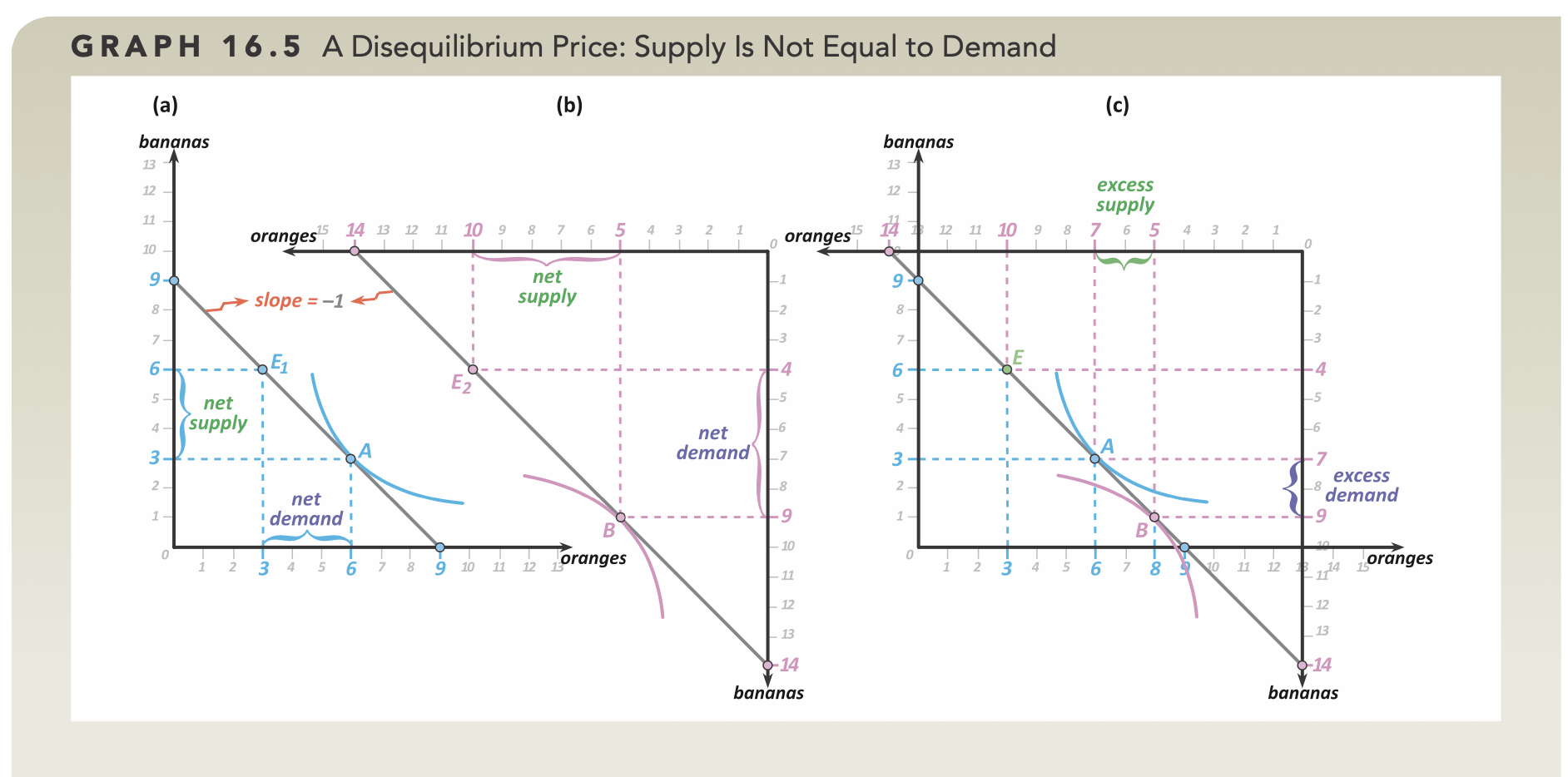

- Example of a Disequilibirum. Here. price is set to 1 orange=1 banana. Blue player will move E1→A, and red E2→B. But those two points do not meet.

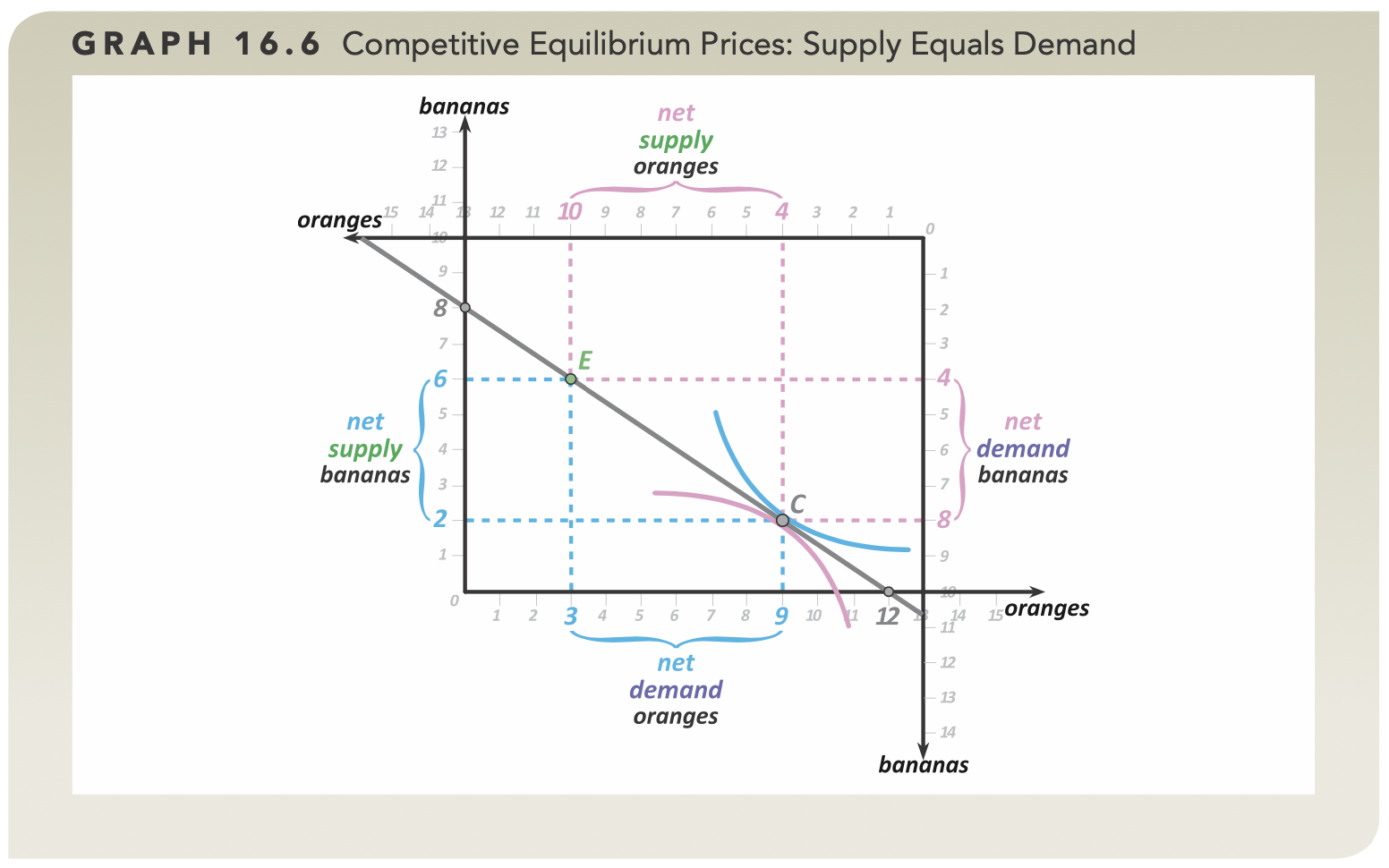

- Example of Equilibirum. Here, price is set to 1.5 orange=1 banana. Blue moves E→C, and Pink moves E→C and therefore demand for bananas is equal to supply of bananas, and demand for oranges are equal to supply of oranges.

- Solving for the equilibirum:

- Get the Ordinary Demand for good x1 from both parties.

- Set the equilibirum condition Qdemand=Qsupply

- x1A+x1B=e1A+e1B

- Demand by A+Demand by B=Endowment of A+Endowment of B

- Solving this for the price ratio p2p1 will yield the relative price (=price that will lead to a trade that results in an equilibirum).