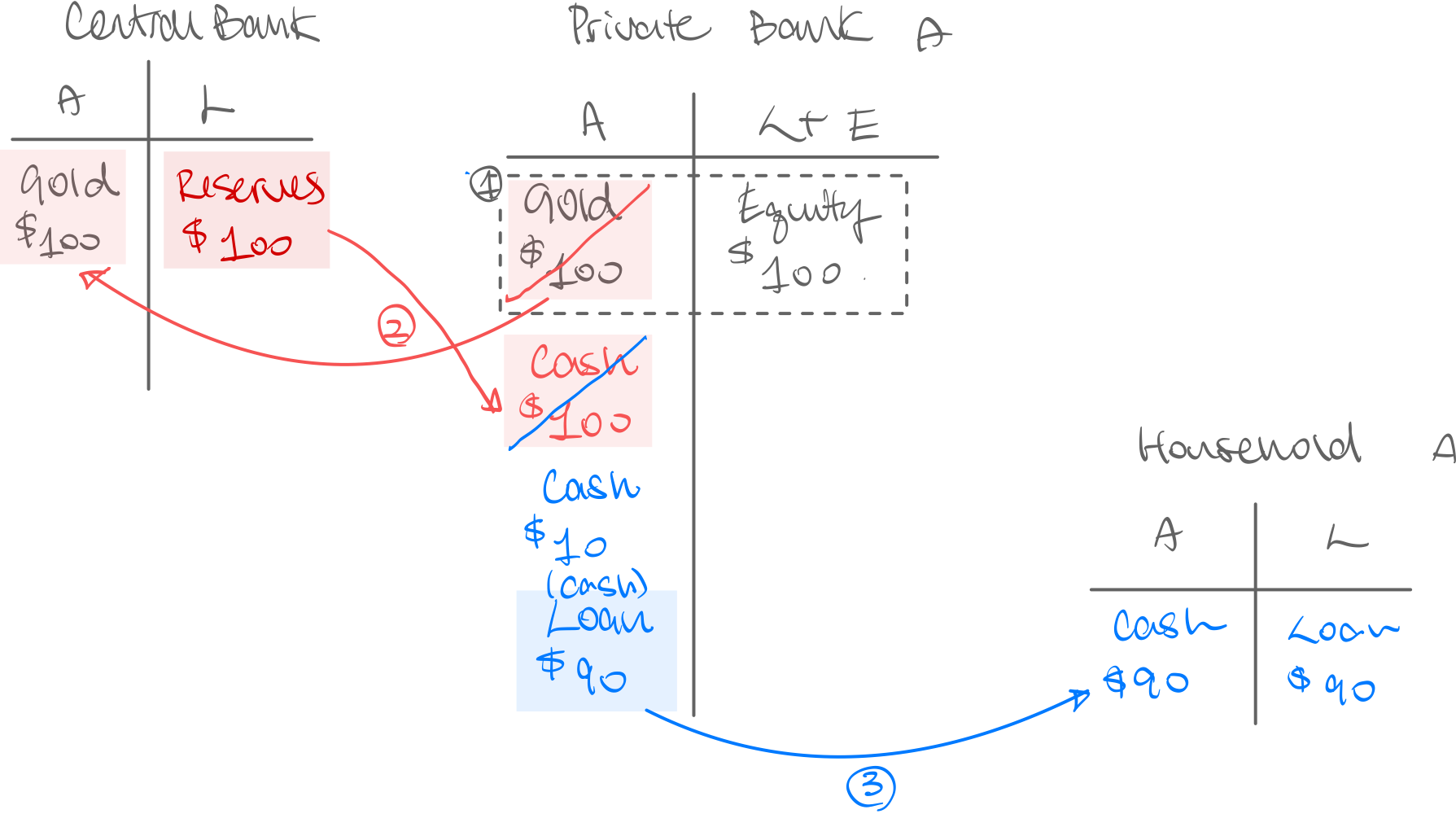

Central Bank Prints Money

Motivation. From Money (Medium of Exchange). This is exactly how the central bank prints money, under these rules:

- Gold Standard: Central bank guarantees that you can give it cash and it will give you gold in return. Central bank is the only bank that can print money (=reserves)

- Balance Sheet must always be balanced, except for that of households

Central Bank Prints Money (M0)

- Private bank A is established. Owner invests 100 equity balancing it out

- PBA deposits gold in the central bank, and in return it gets $100 in cash

- HHA asks for a loan of $90 dollars. PBA grants it.

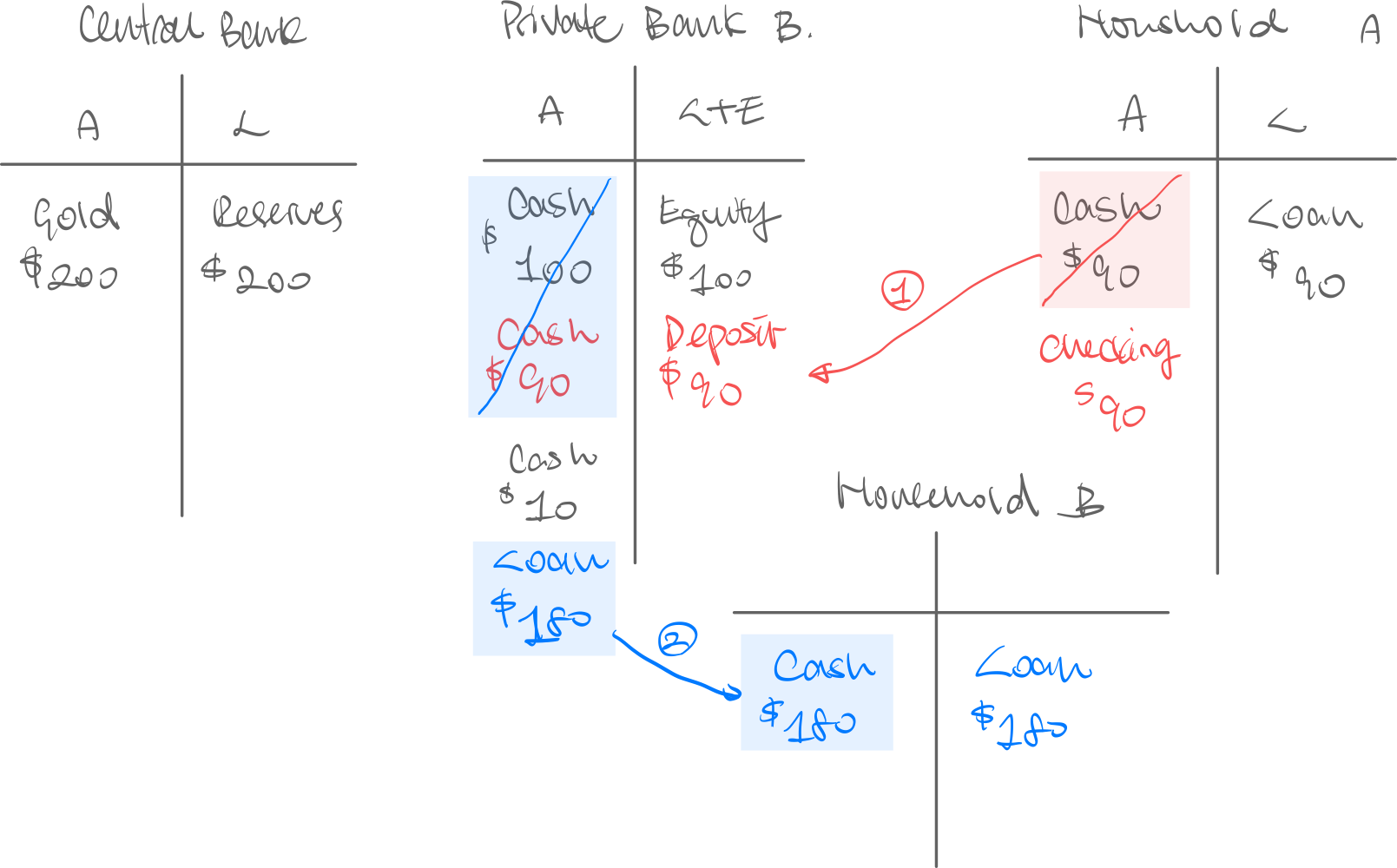

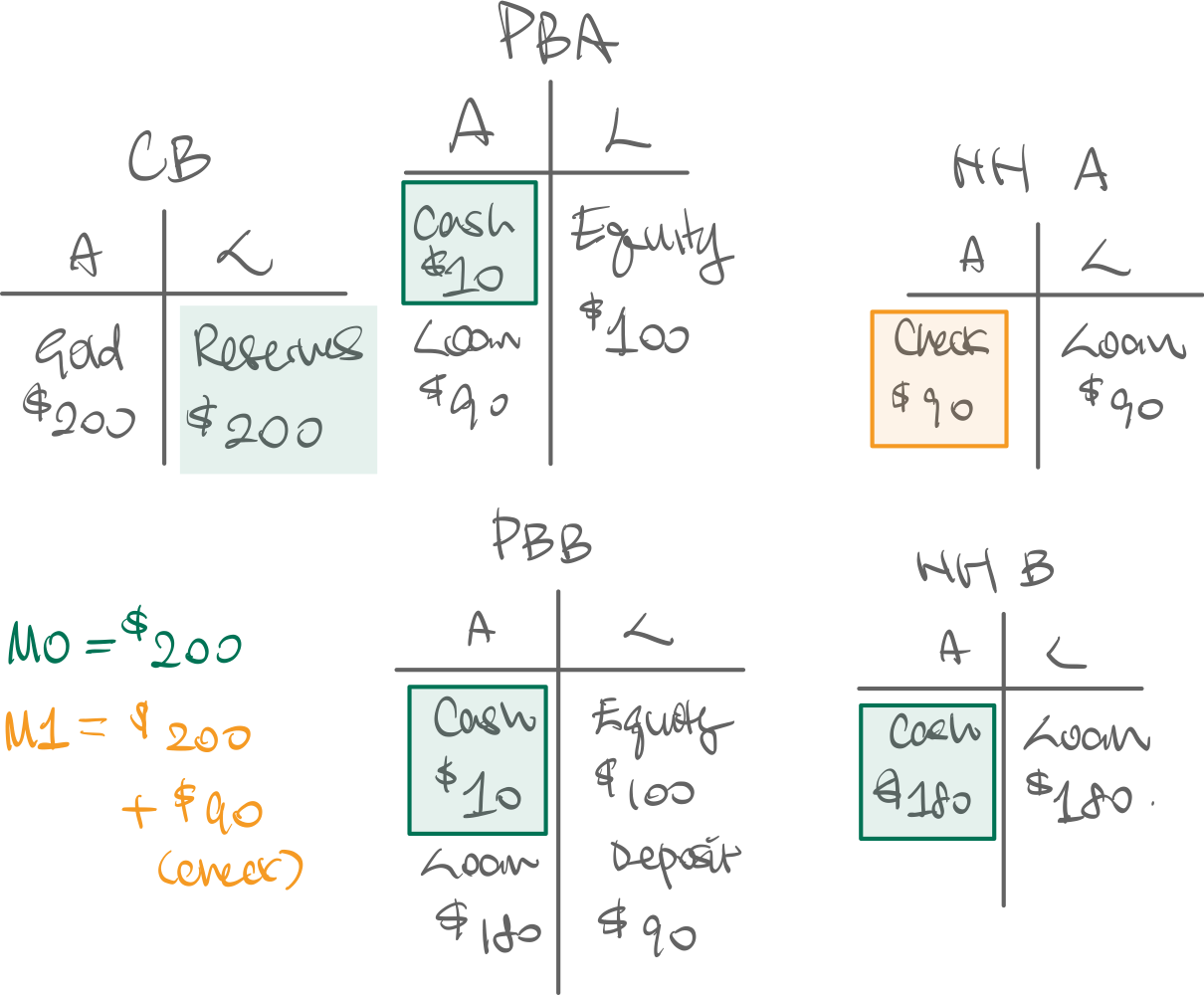

Depositing in a Private Bank in a Checking Account (M1)

PBB is establsiehd, has already performed the depositing gold into the CB for cash.

PBB is establsiehd, has already performed the depositing gold into the CB for cash.

- HHA takes the cash from the loan from PBA, and deposits into PBB.

- HHB asks for loan of 90 in their deposit, which can be used in transactions. We therefore have two types of money in circulation:

- : all the paper cash printed and exists in bank vaults or household’s hands

- : M0 + all the checks written by (accreddited) private banks that can be used in place of paper cash We also have:

- : M1 + all the savings account, etc. and other illiquid forms def. Liquidity. How easy it is to convert to M0. M2 is very illiquid, while M0 is very liquid.

Central Bank Interest Rates

The minimum Interest Rate declared by the Federal Reserve.

- This is what we mean when we normally say ”The Fed is increasing instrest rates” as Monetary Policy

- Called different things in different countries

| Nation | Name of Rate | Central Bank |

|---|---|---|

| U.S. | Federal Funds Rate | Federal Reserve (Fed) |

| Eurozone | Main Refinancing Rate / Deposit Rate | European Central Bank |

| UK | Bank Rate | Bank of England |

| Japan | Policy Balance Rate | Bank of Japan |

Motivation. The central bank’s only ability is to print money. But via this power, it can control the real interest rates. This is called the open market operations. Before that, however, we need to understand overnight loans

Open Market Operations

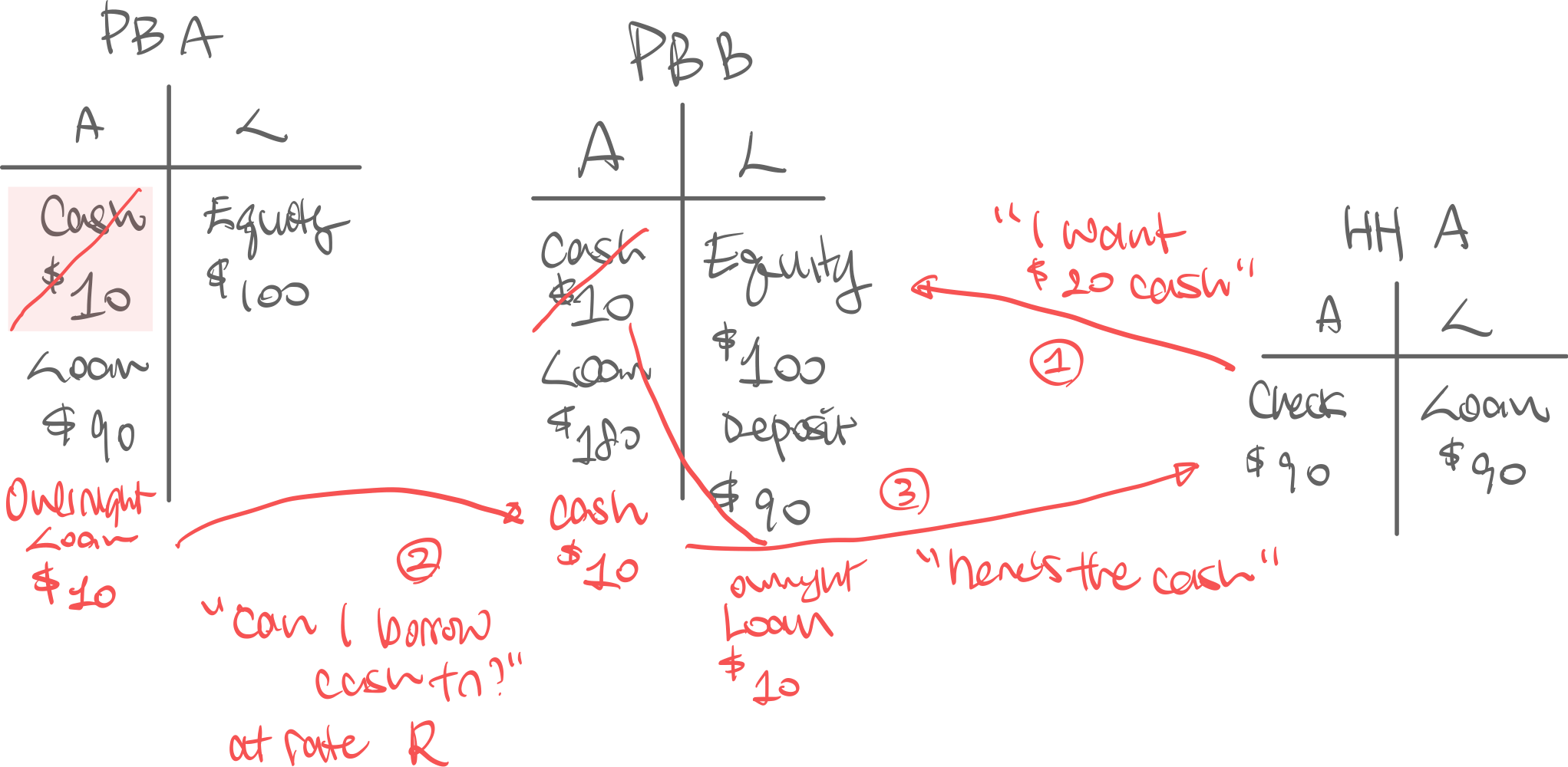

Overnight Loans

Continuing scenario:

Continuing scenario:

- HHA requests to withdraw $20 from their checking account in PBB

- PBB doesn’t have enough cash on hand, so goes to PBA and asks “can I borrow R$?”

- PBA gets the cash, and gives HHA the cash withdrawal

Open Market Operations

This rate is by definition the nominal interest rate. The central bank can control this rate because:

- CB prints more money

- Supply of money for PBs increases, Demand for overnight loans (=cash) by PBs decreases

- (Law of supply and demand) Price of money in overnight loans, , decreases. Thus more money means lower nominal interest rates.

Private Bank Operations

- As seen here, banks are ultimately in the business of “borrow in SR, lend in LR” and pocket the interest rate spread (=difference in interest rates from borrow side and lend side)

- Investment Banks are a little different, because they deal in stocks. They act as market makers for stocks, and also pocket the underwriting spread (=difference in prices from buy side and sell side)

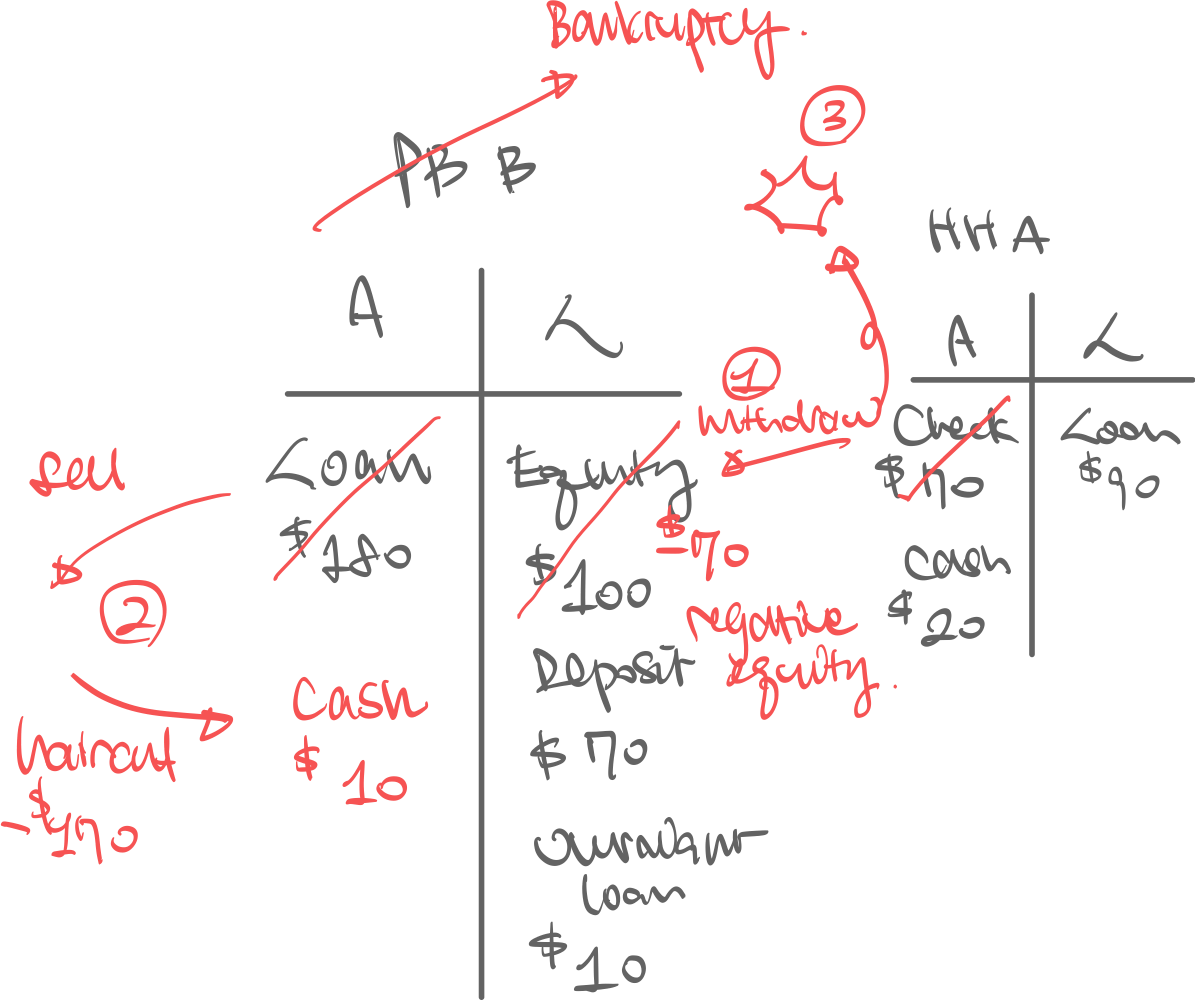

- In times of crises: 1. People withdraw more (bank run) 2. Sell loan at haircut → Bank equity decreases to match 3. If selling loans and cash and reserves can’t keep up with increasing liabilities we have bankruptcy 4. To prevent this: 1) Federal Deposit Insurance Company (FDIC) and 2) Required hold in reserves (~10%)

Monetary Policity Transmission Mechanism

Motivation. Monetary policy that affects the overnight lending rate affects government bond yields.

Relation to Fiscal Policy

Nominal government budget constraint at time :

where is the central bank purchasing government bonds

The minimum Interest Rate declared by the Federal Reserve.

- This is what we mean when we normally say ”The Fed is increasing instrest rates” as Monetary Policy