Motivation. Unlike the Real Business Cycle Model or the Coordination Failure Business Cycle Model, in reality it’s pretty hard for companies to change prices, wage contracts to change, etc. This is called the menu cost, and we assume this is so big that firms can’t change the prices in the short term.

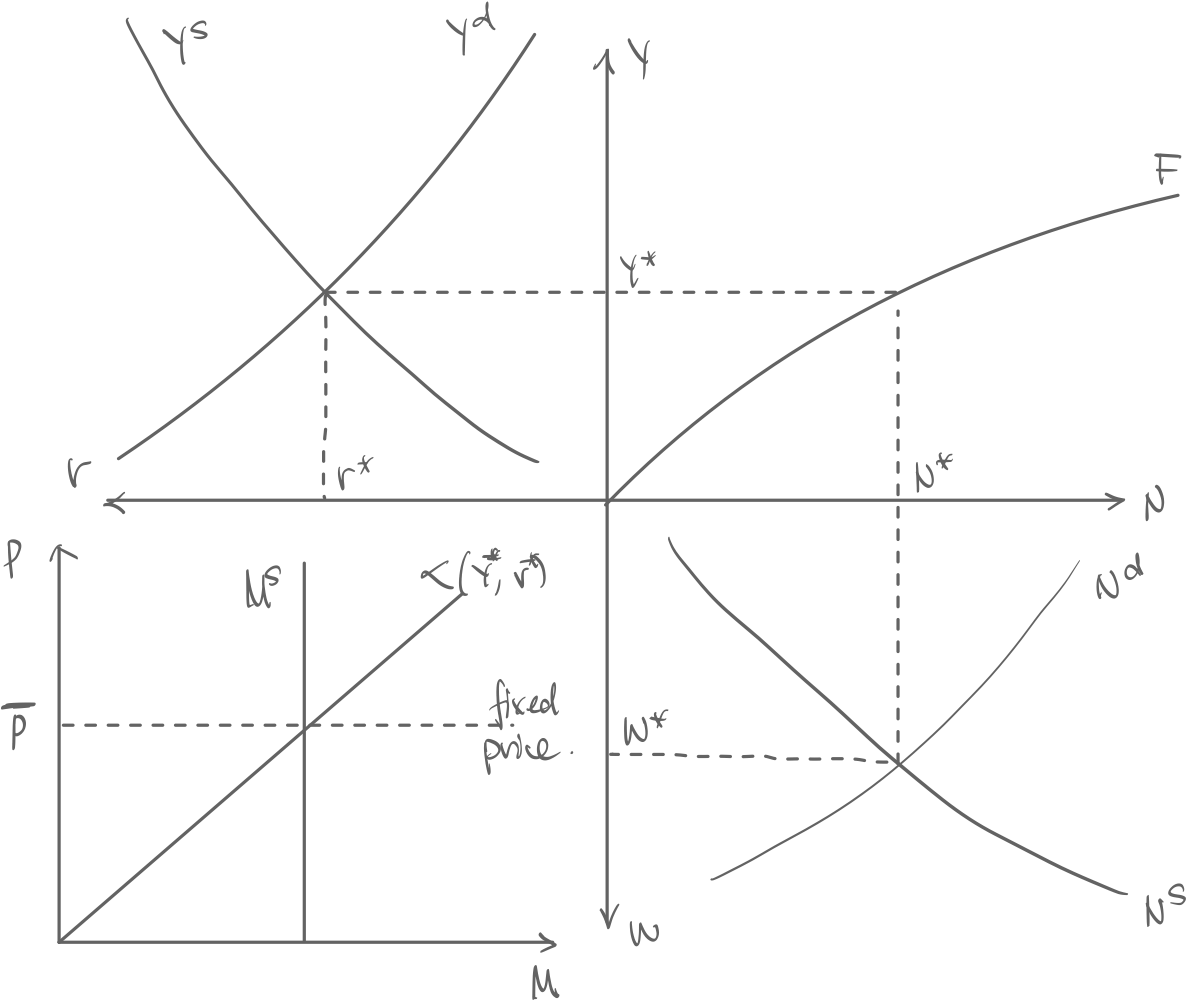

We still have the same Intertemporal Consumption-Leisure Optimization (Full General Equilibrium) model and the Money Market but with the key difference: Price levels are fixed.

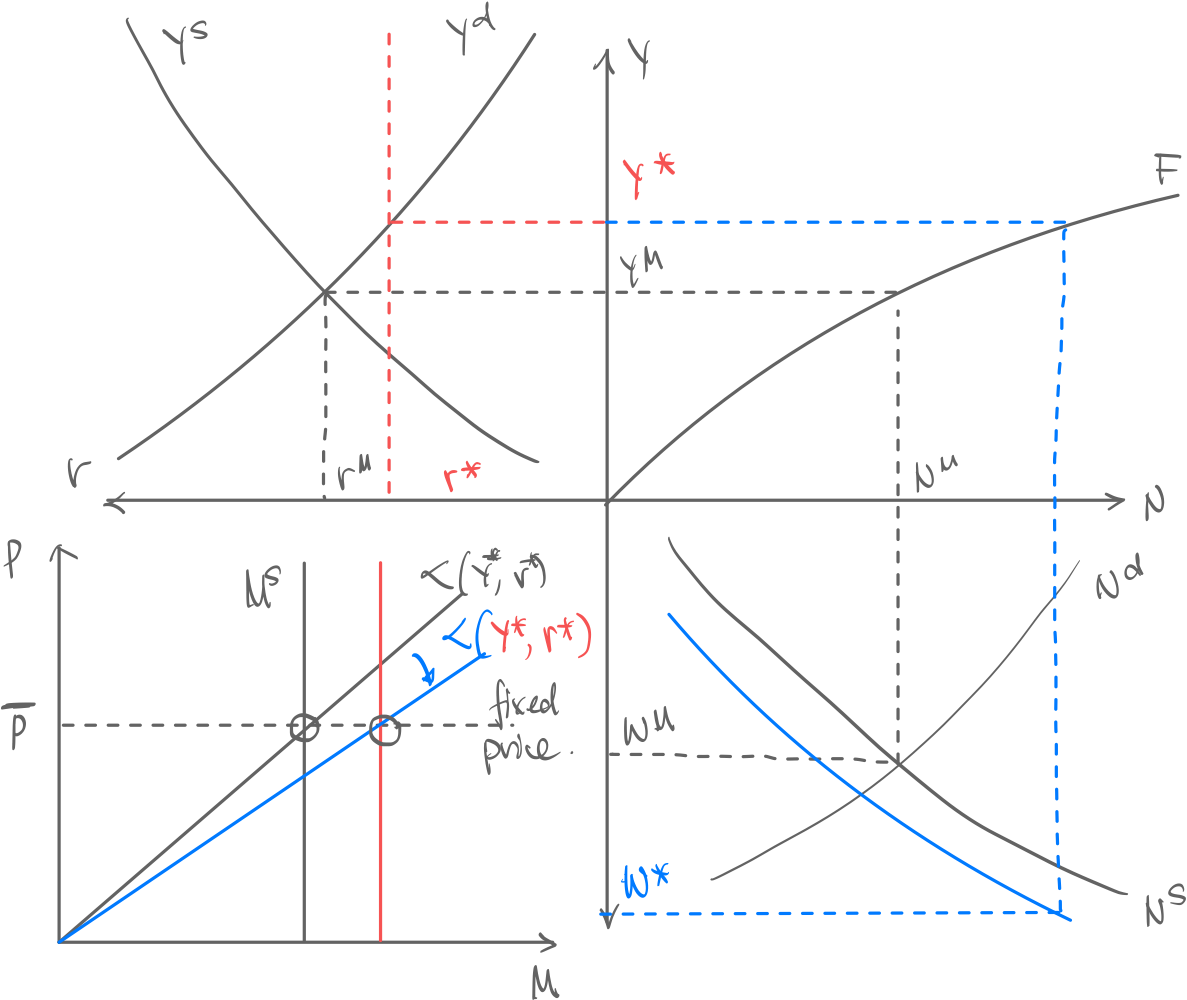

Now assume that for some stupid reason the central bank increases money supply in order to decrease interest rates. Note that:

- ass. Sticky Prices. Price level is fixed no matter what.

- ass. Demand-Determined Output. The output is always demanded, not supplied. At a given , the is read off from the curve, not the curve.

- The labor demand curve is irrelevant. Read the off the production function based on from the curve

Then:

- Central bank sets target interest rate , and matches the to target that interest rate

- Households…

- Demand more at lower

- Decrease labor supply (work tomorrow instead)

- Firms…

- Start producing more to match the higher demand at new lower

- Employ more people at new higher wage to meet higher demand

- Liquidy demand expands as rates decrease and output increases, to meet the new Money supply at the same