Futures contracts are same as Forwards but is exchange-traded. The pricing formula is exactly the same, but there is less counterparty risk because the exchange verifies the counterparty.

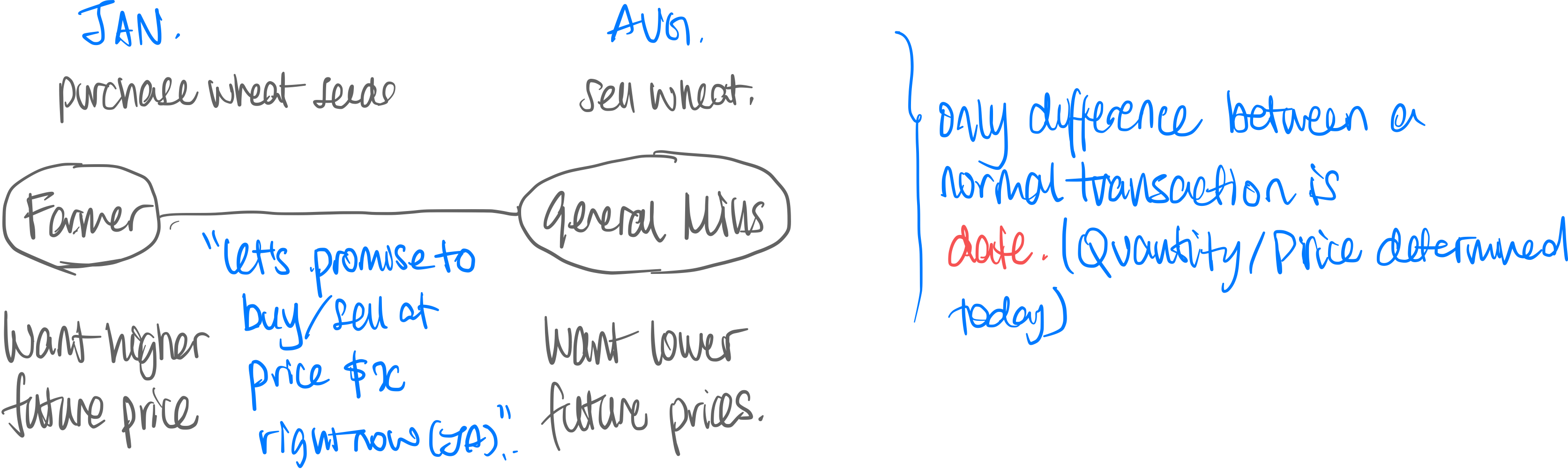

A future is a contract that says “A will sell B a certain amount of resource R for $X at date N in the future.” This is because A wants to hedge against depreciation of R, and B appreciation of R.

- Reduces risk for both parties

- Farmers have long position on wheat (=worry that wheat price↑)

- General Mills have short position on wheat (=worry that wheat price↓)

- i.e.#Short =#Long positions (you can’t subdivide a contract)

- Used for liquid (=high trade volume) assets, usually highly demanded commondities like gold, oil.

- Futures Price Formula.

-

is the spot [current] price of the commodity

-

is the riskless rate, continuous compounding at timespan (%)

-

is the carry rate, continuous compounding at timespan (%)

-

is the time to maturity (timespan)

-

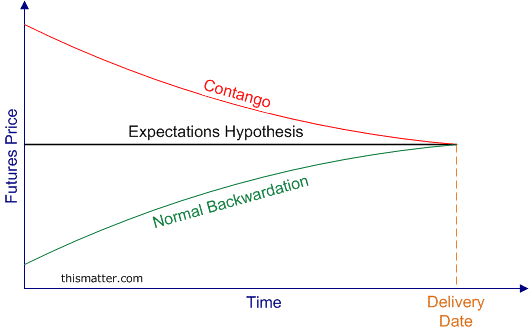

Futures Price > Spot price (=Contango)

- …unless Backwardation: Futures Price < Spot Price. ← This is abnormal.

-

Futures Price converges to Spot price as it closes into maturity

Futures Exchanges are large corporations themselves which manage these contracts.

…examples: Chicago Mechantile Exchange (CME), Tokyo Commodities Exchange (TOCOM), etc. …Transactors have escrow accounts to not incur fees and ensure safety of assets …Ensutre parties aren’t bankrupt and can carry out the exchange

Rolling the Contract. You don’t want to take delivery of the contract, but the contract is expiring soon. What you do? ⇒ You roll over the contract, i.e. sell your current contract and buy another one that matures later.