thm. The price of a bond is the following:

where…

- is the current market price of the bond

- is the periods left to maturity (where is the years left to maturity)

- not periods passed! periods left

- is the Principal amount

- Normally use 1000

- is the per-period (=semi-annual) coupon payment

- normally, coupon is quoted at annual coupon rate (in percent) so

- (or ) is the yield to maturity (discount rate)

- is the current yield.

- is the number of coupon payments (semi-annual for Treasury bonds)

The Three Rates of Bonds

- : Yield to Maturity—“What’s the return rate for the coupons if I hold until maturity?”

- : Current Yield—“Coupon rate, but at the current bond price”

- : Coupon Rate—“Coupon rate (at principal price).”

- Price and rates:

- Trades at premium ⇔

- Trades at discount ⇔

Observe…

-

.

-

-

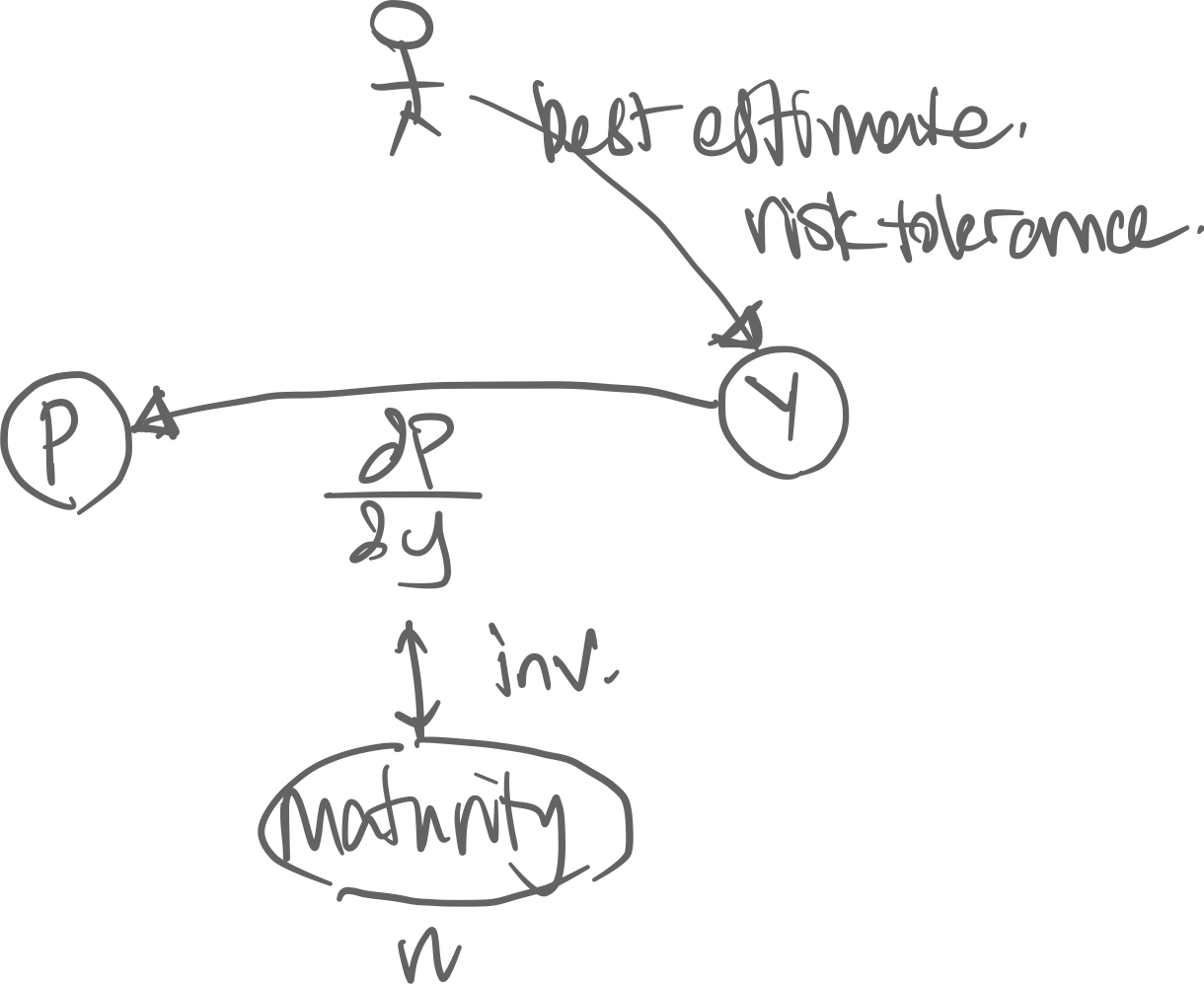

Causality: Exogenous factors → yield → price.

-

In a portfolio of bonds…

The causality of the variables of a bond. The market’s expected rate of return of a bond is the yield. With this yield we can calculate its price.

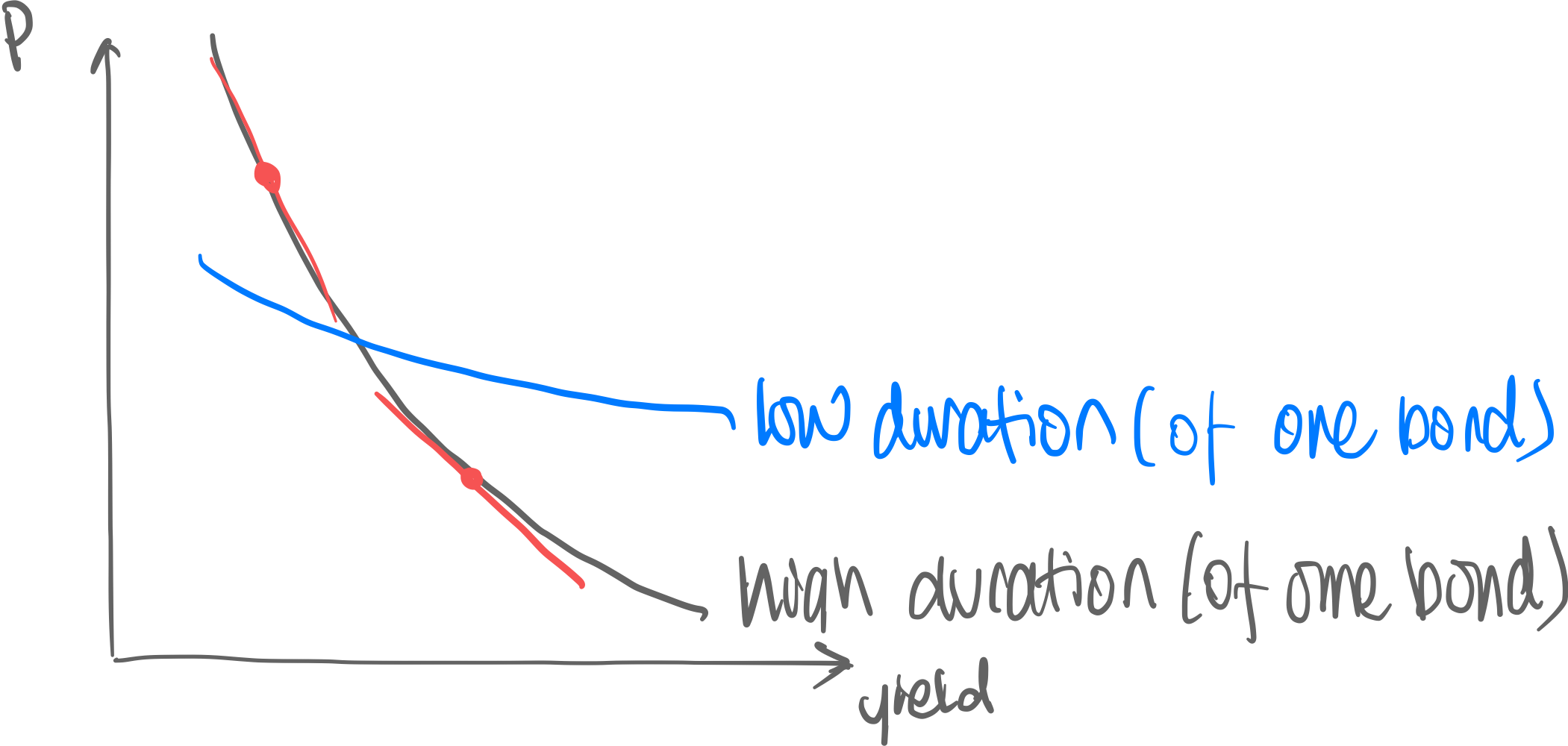

Price—Yield Curve (mathematical)

Price and Yield are inversly correlated → Price-yield curve looks like this:

Duration is the gradient of this price-yield function:

Dollar Duration (DV01) is the change in price due to 1% change in yield [=$1 change in yield per par]

- Dollar Duration can be only used to approximate price changes for small changes in yield (~50bp)

- Duration is used to estimate risk (Price sensitivity against yield = DV01 risk

- Dollar Duration is quoted as an absolute value. (We all know that it’s mathematically negative)

- DV01 Risk:= = “ market value for 1% yield change” =

- DV01 has no relationship with volatility

Example calculation

| Time to Maturity | DV01 | Yield Vol. | e.g. change in yield | change in price |

|---|---|---|---|---|

| 2 year | $1.8 | 10%p | 20bp | $0.36 |

| 10 year | $7.2 | 5%p | 10bp | $0.72 |

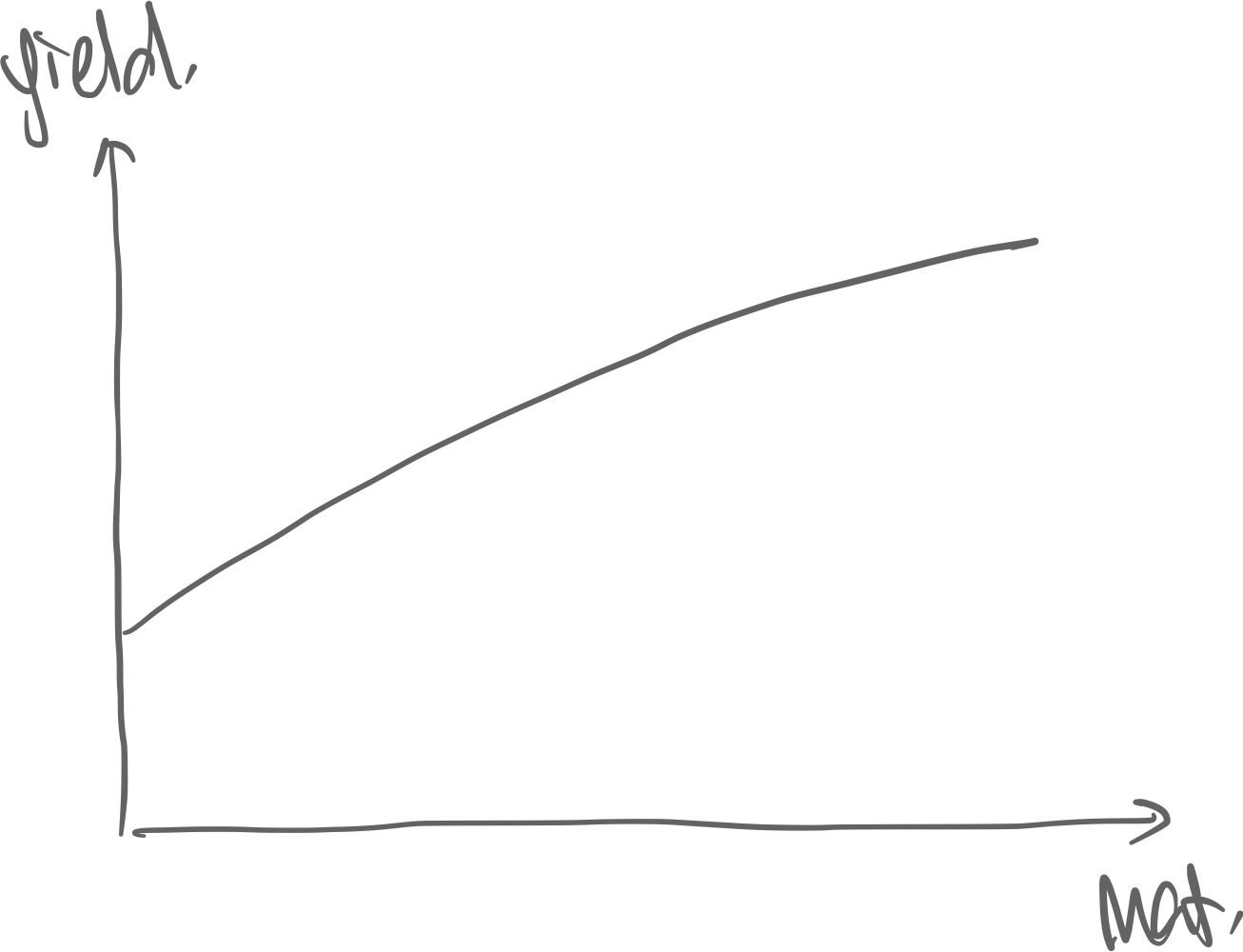

Yield(–Maturity) Curve (empirical)

⇒ Yield Maturity, because the farther away the cash flows are, the more risky it is [ uncertainty]

- Inverted Yield Curve: Bond investors think a recession is looming → Treasury will increase rates

- Left intercept is the fed rates & short-mat bonds → high movement right side is long-mat bonds → low movement

Risk & Volatility

def. Price[rate of return] volatility = (in $)

def. Yield volatility = (in %p)

def. DV01 Risk = Change in MV per change in 1% yield

- Yield Vol > RoR Vol ← mathematical relationship (price formula)

- Maturity Price Vol.