Definitions

- Monopoly is when a single firm has all the Market Power. Monopolies normally have:

- High barriers to entry

- Production in elastic portion of demand

- Single firm with market power

- (usually) economies of scale

- A Natural Monopoly is when it’s hard for firms to achieve break-even without a monopoly market strucutre

Market Demand for Monopolies

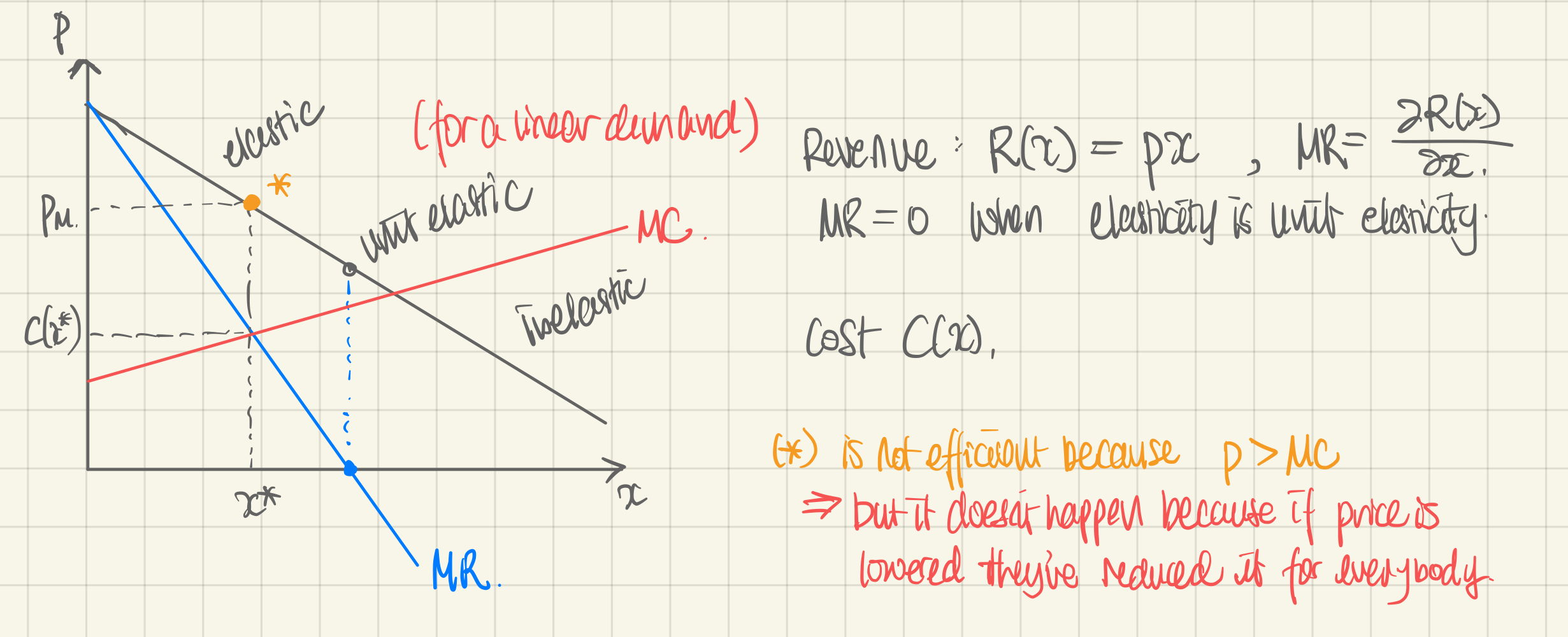

MR > 0, i.e. where ε > 1

- Monopolies face the whole market demand curve.

- Marginal Revenue (MR) curve will slope down with the same intercept and twice the gradient of the Demand curve.

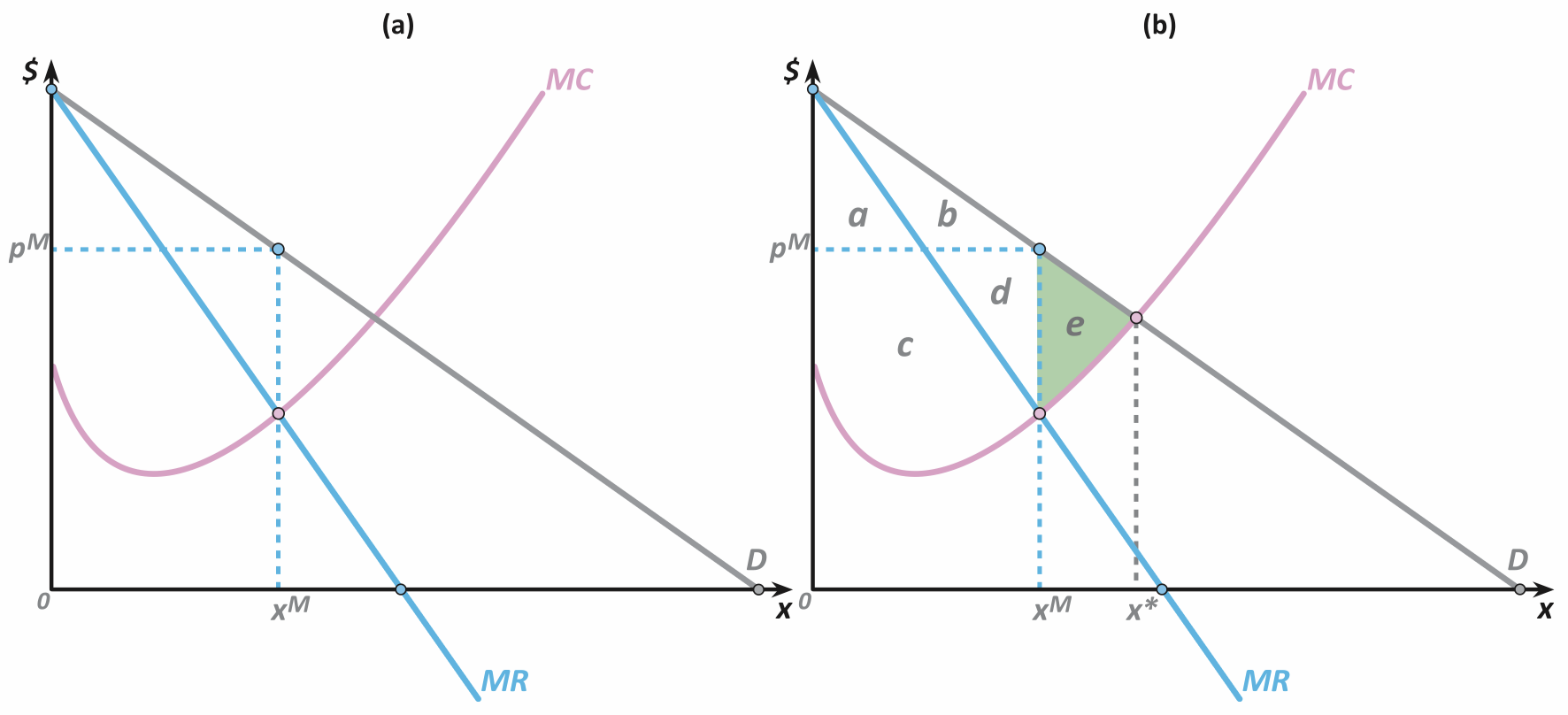

- Visual Profit Maximization when (See below for math)

- Firm produces (=monopoly quantity)

- Market price settles at (=monopoly price)

- Firm makes profit of

- Deadweight loss is

- DWL happens because monopolist increase price more than optimum

Profit Maximization for Monopolies

Profit maximization for monopolies:

- is the inverse of the Ordinary Demand of goods

- is the Cost Function that is derived w.r.t

- ! Not simply !

- To solve, use Unconstrained Maximization

- First Order Condition:

- This is the same condition as condition.

- ! In third-degree price discrimination, can only be used if is constant.

- When elasticity is constant ⇒ Use the Elasticity condition:

- Elastic: thus excess profit

- Unit elastic: thus zero profit

- Inelastic: thus negative profit (monopolist doesn’t produce)

- First Order Condition:

Price Discrimination for Monopolies

First Degree Price Discrimmination

Everybody pays exactly how much they’re willing to pay.

- Demand curve is same as marginal revenue curve

- Pareto efficient because there is no deadweight loss; everybody pays exactly as they want to pay, and no extra profit is lost

- → but the benefit goes to the monopolist only

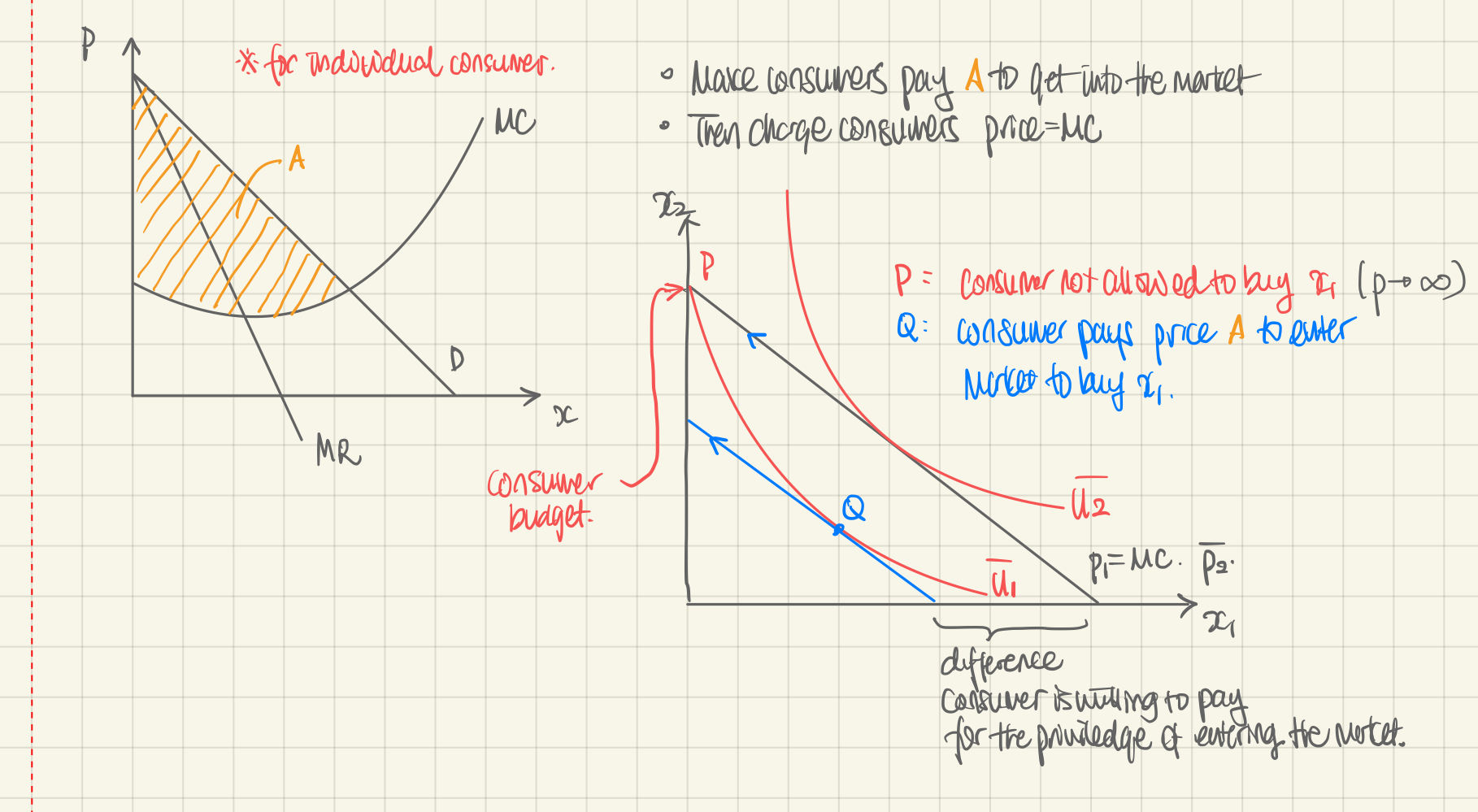

Two-part Tariff

- Consumers are made to pay amount A to enter the market

- Then charge consumers

- Same as Equivalent Variation

Process of enforcing the tariff

- Consumers at utility and only buys good

- Firm enters the market and starts selling good at price . The consumer gains utility

- Firm realizes they could get more profit. They charge amount to enter the market. Thus the consumer loses amount of .

- Consumers are back to , but they’re still buying because they’re just as happy as when they only bought .

You can get market ticket price by either

- using Equivalent Variation on the right graph

- using integration on the left graph

Third Degree Price Discrimination

- Idea: Charge differently based on consumer characteristics (=based on Price Elasticity of Demand)

- ⇒ Split consumers into two groups with elasticity and…

- If is constant → use the elasticity condition

- If is not constant → use normal profit maximization:

- You will eventually get and