Assume the Efficient Market Hypothesis.

Info

How to maximize returns while minimizing risk [=volatility =std. dev.]? → Since risk/return is proportional to each other, you choose one optimization goal.

- Single Stock (See Dividend Discount Model)

- Price of stock at time :

- Return of stock at time :

- are all Random Variables

- Expected Return of stock :

- Volatility (=Risk) of Stock :

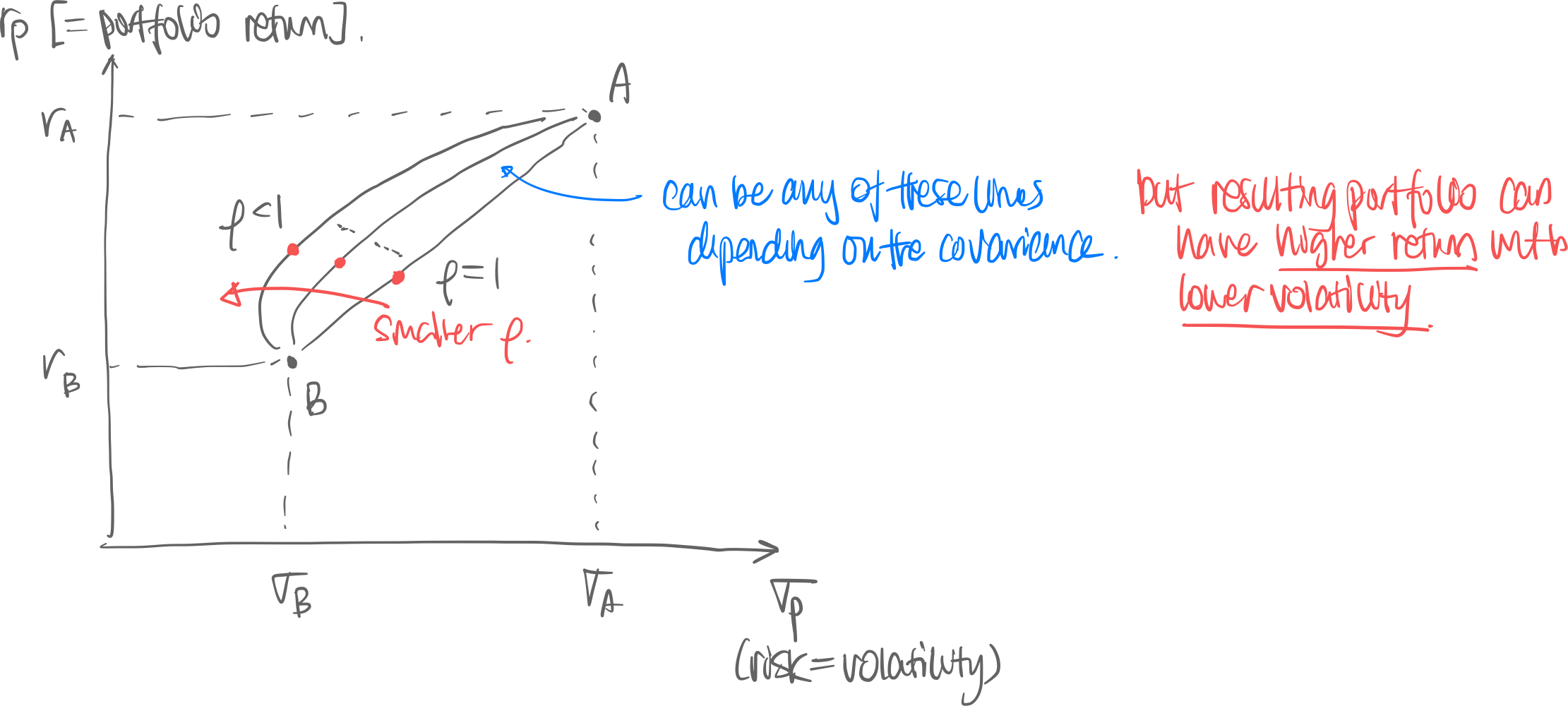

Two-stock Portfolios

- Covariance of stocks :

- Correlation of stock : such that

- Weights for

- Portfolio Expected Return:

- Portfolio Variance:

- Minimum Variance Portfolio:

N-Stock Portfolio

- Known information: are all known

- Multiple Stocks (=Portfolio)

- Position of portfolio at time (=amount invested):

- Portfolio Return at time

- Portfolio Expected Return at time :

- Portfolio Variance:

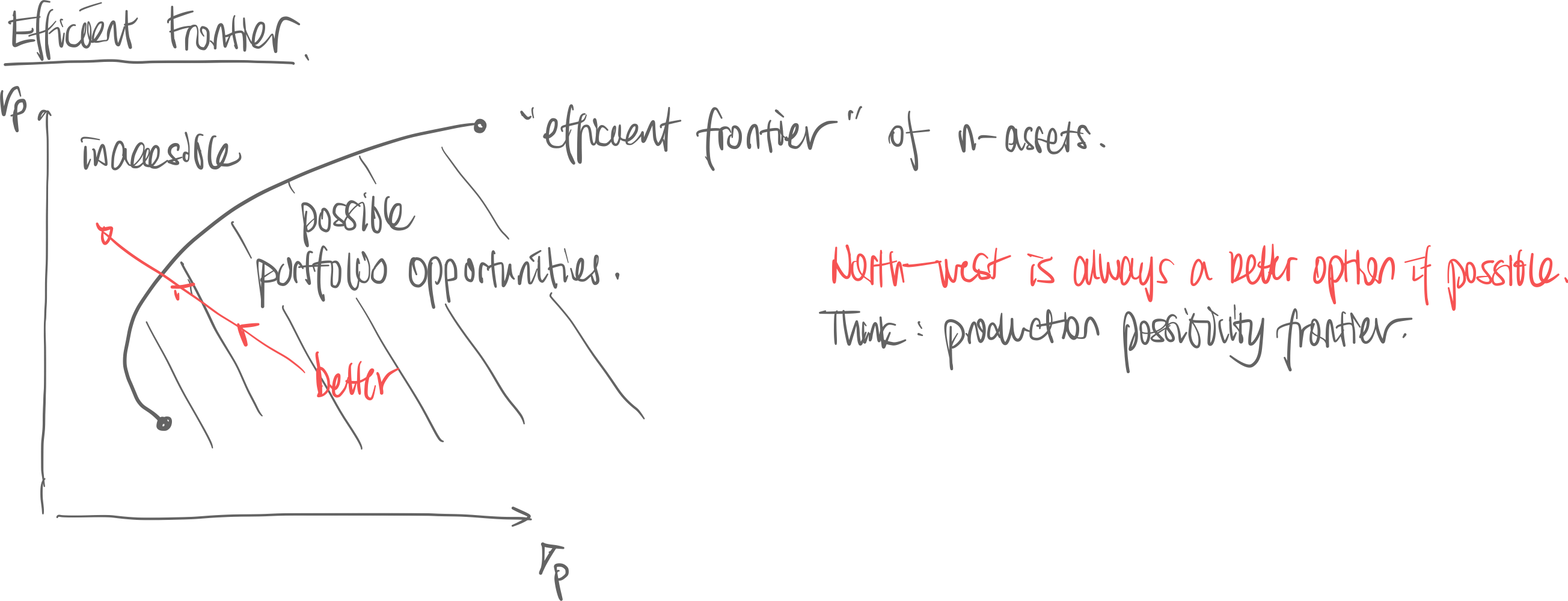

def. Feasible Portfolios. Set of tuples given we have many assets weighted .

- ← Short-selling is allowed

- Lower the correlation [= the more negatively correlated] the better diversification is.

- When two stocks have perfectly negative correlation , the efficient frontier touches the -axis (=)

- When two stocks have perfectly negative correlation , the efficient frontier touches the -axis (=)

Efficient Frontier

- “Minimize the variance such that the sum of weights are and the portfolio return is (a constant)”

- Key Assumption: neither the returns or risks are identical, and there is no perfect correlation

- Minimum for given return level at:

- Efficient Frontier:

- …where are scalars: