Firms will choose price as the strategic variable.

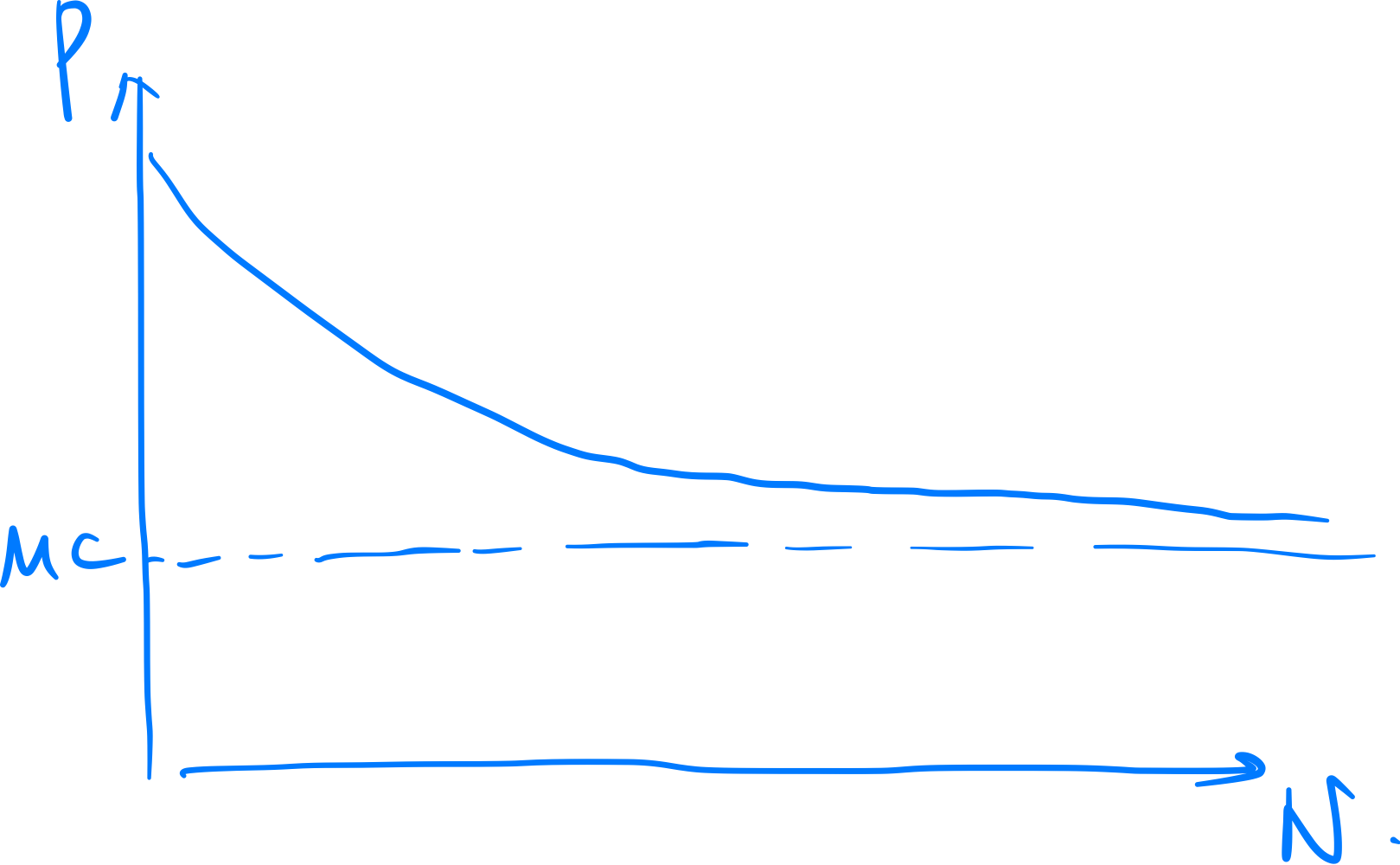

- Market Demand where are constants

- Simultaneous game

- Firm with lower price captures all of demand

Case: Constant and Same Marginal Cost

- Marginal Cost is constant for both firms: ,

- Both firms will attempt to undercut each other.

- where both firms have zero profit

Case: Different but Constant Marginal Cost

- Marginal Cost is constant, but different for both firms

- , ,

- Then…

-

- & firm 1 can set undercut the price because they still have

- Firm 1 will make positive profit; firm 2 will make zero profit.

Case: Sequential Move

- Change assumption: Dynamic game; firm 1 sets price first, then firm 2 sets price. ()

- Then, there cannot be a best response curve. Instead, consider the following subgame perfect Nash equilibirum:

- The following is a non-subgame perfect Nash equilibirum. The non-credible threat is when firm 2 threatens "I'm just gonna lose money if you don't listen.". Given a constant $k$,

- Different order: Dynamic game; firm 2 sets price first, then firm 1 sets price. ( still assumed)

- Then, SPNE

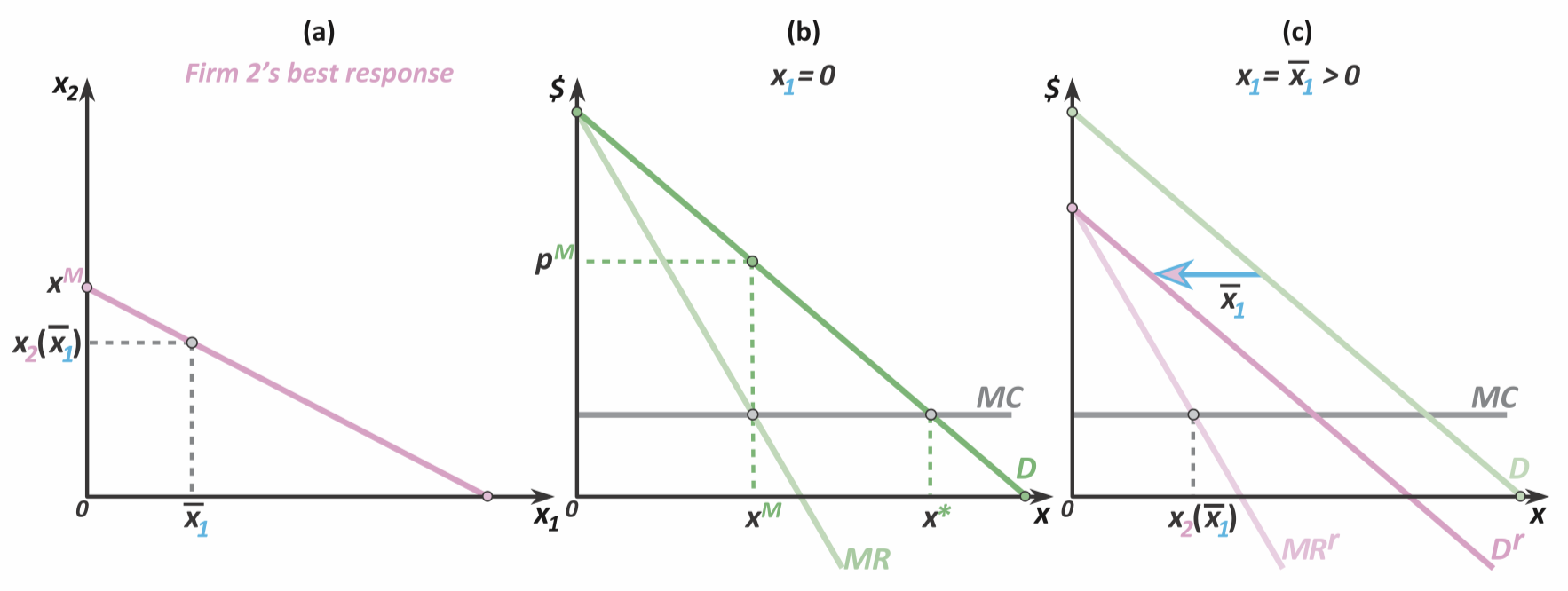

If Product Can Be Differentiated

When we assume that products can be differentiated (=diversified), then we can improve on the Bertrand model;.

- Consumers’ preferences are uniformly distributed across differentiation space

- Firms can produce a product with a certain value of differentiated characteristic

- A consumer with preference will pay a cost when consuming which is proportional to the distance

- Assume there exists a possibility of differentiation space ()

- However firms are not allowed change product characteristics.

- The only strategic variable is price.

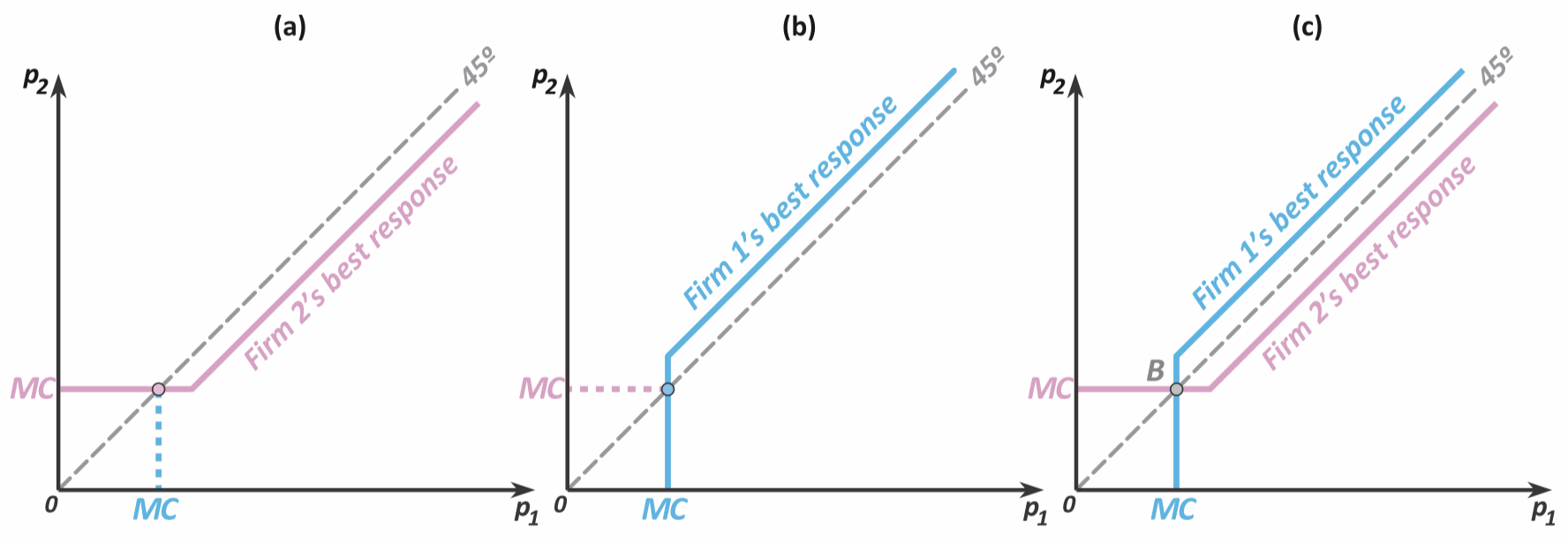

- First consider firm 1’s BRC:

- If firm 1 gives away products for free

- …firm 2 can still charge a price since some consumers will prefer their products

- …and because firm 1 will exit otherwise.

- If firm 2 charges a price

- …firm 2 can charge an even higher price since some consumers will prefer their products

- Therefore the BRC is a positively sloping curve

- If firm 1 gives away products for free

- Firm 2’s BRC is symmetrical:

- → Equilibrium is at the intersection of the two BRCs, and at this point .

- → Equilibirum price is above marginal cost, unlike pure Bertrand Price Competition

Info

Differentiation “softens” price competition. Therefore firms want more differentiation

Determining Firm 2’s Best Response Curve:

- when firm 1’s price < MC, firm 2’s best response is set price at MC

- when firm 2’s price > MC, firm 2’s best response is the undercut firm 1’s price by a very small amount ()

- Firm 2’s BRC is symmetric → Firms’ prices will unravel to both pricing to p = MC (Bertrand price = MC) → At , market will purchase , and firms produce each.

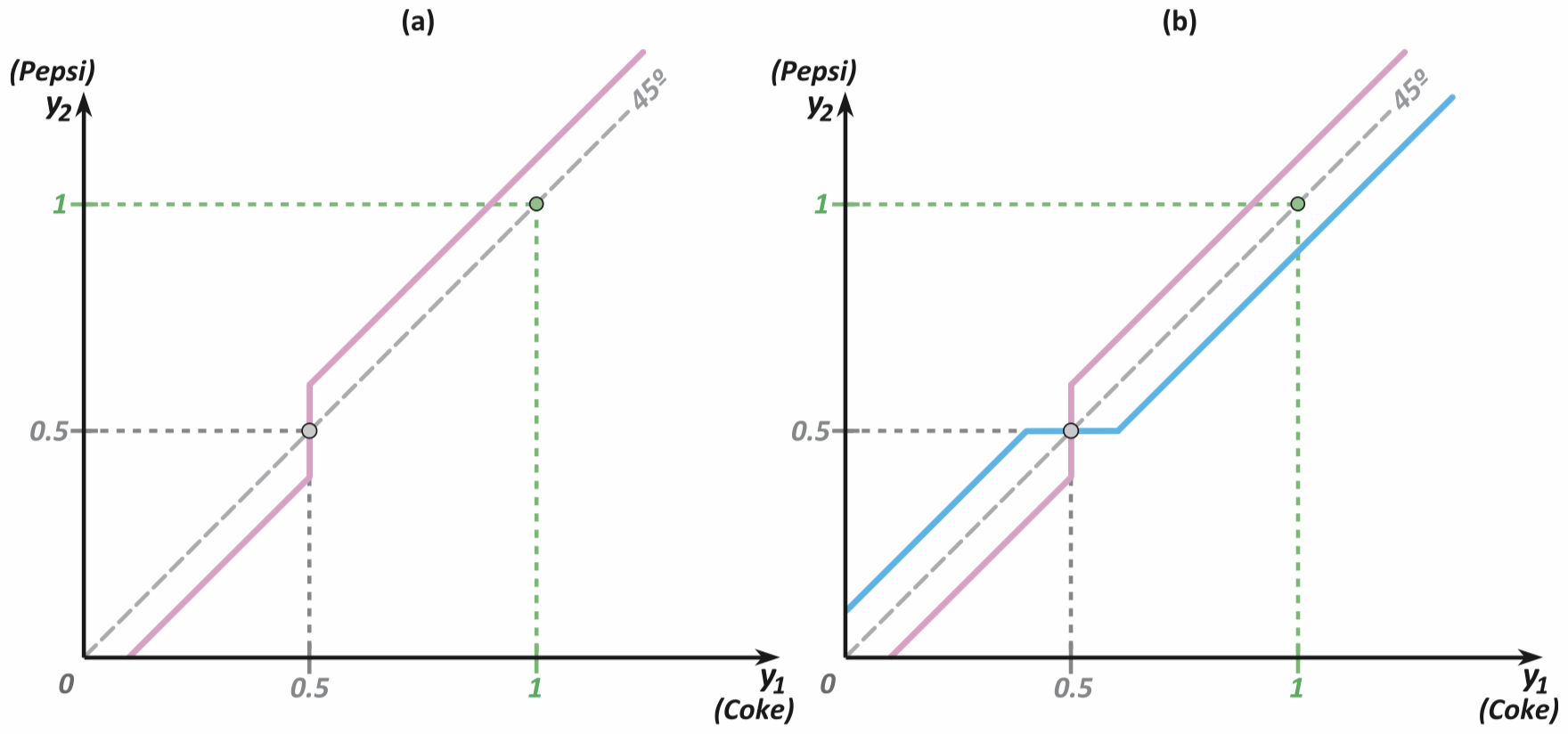

Hotelling Model

- Products can be differentiated by one characteristic variable which ranges from 0 to 1.

- Differentiation is the only strategic variable; i.e. price, etc. cannot be changed.

Tip

The graph and its corresponding explaination in the textbook is wrong; the following is the correct explaination.

Thinking about Firm 1’s BRC:

- when firm 2 produces a product with characteristic < 0.5, then firm 1 will produce a product that is just closer to 0.5 [=larger] to capture more consumers

- when firm 2 produces a product with characteristic > 0.5, then firm 1 will produce a product that is just closer to 0.5 [=smaller] to capture more consumers

- when firm 2 produces a product with characteristic = 0.5, then firm 1 will produce a product with characteristic = 0.5.

Info

In a single axis (1-dim. differentiation space)

→ Firm 2’s BRC is symmetrical; this unravels to the equilibrium where both firms produce product with characteristic = 0.5

Circle Model

The circle model combines the Price Competition and Differentiation.

- This is a sequential game where firms will enter [first move] and then it will compete with price [second move]

- Firms who enter incurs entry cost (an economic cost) of FC when they enter.

- Price and differentiation are the two strategic variables.

- Product differentiation space is around a circle whose circumference is 1.

Then the following conclusions:

Info

Each firm is respresented as a point on the circle.

- Firms will enter as long as …①

- Firms compete with their immediate neighbors → Firms will space themselves out around the circle

The number of firms entering and the equilibrium price given that firms have entered are determined in the following order:

- where (∵ ①)

- where but . Specifically: