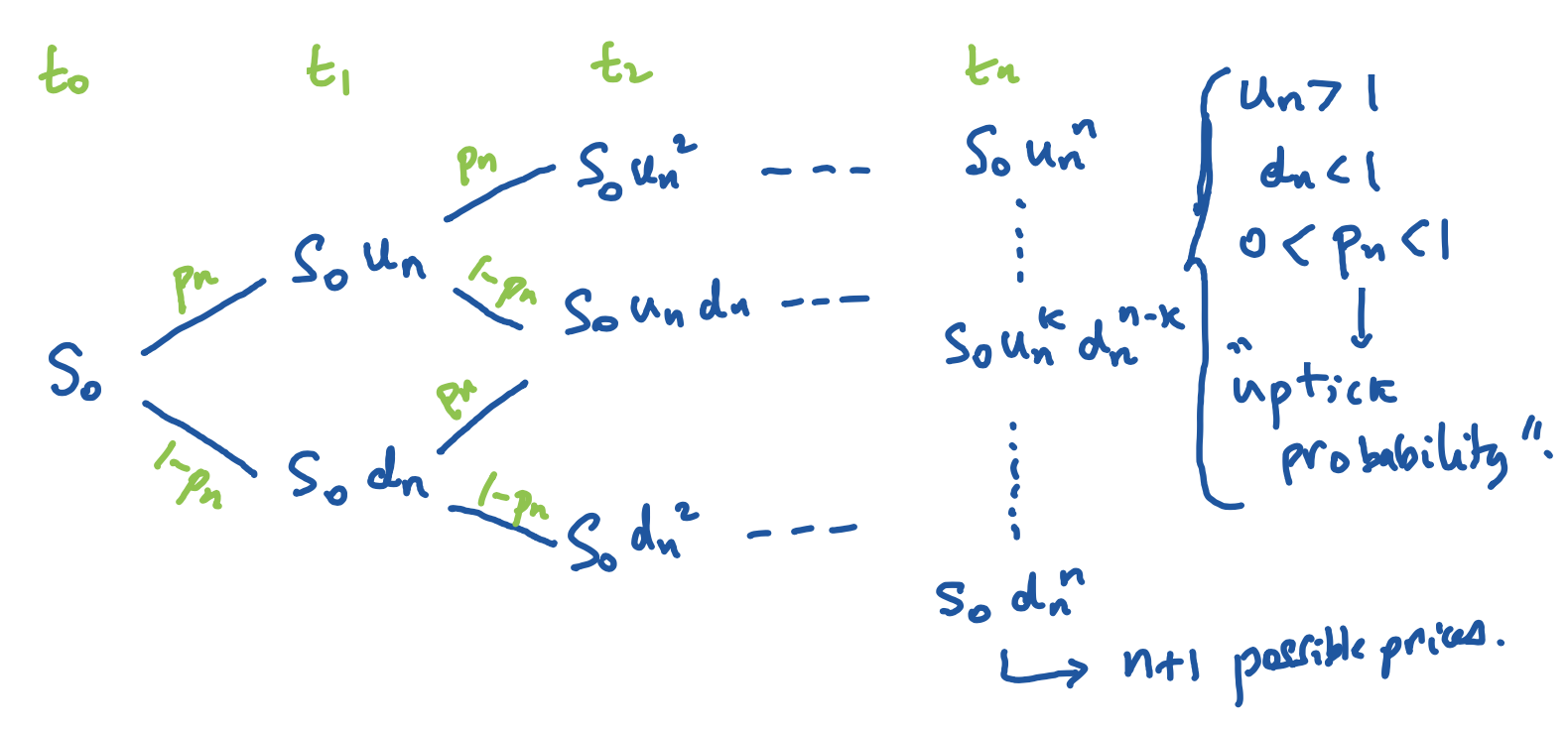

Model Definition

- Consider time interval

- total time

- intervals

- : duration of one interval ()

- : price of security at time .

- is given as a constant

- Gross return

- It’s called gross because its in the form of or , not

- Is defined as a Bernouilli Distribution:

- : number of upticks. Is a random variable with Binomial Distribution

- Sample Space

- is for -period binomial tree

- Final Price

- is a random variable.

- i.e. probability that price will be equal to there being upticks is the probability that there will be upticks. (no shit)

- Expectation of final price:

- To find number of upticks from final price we use

- Dividends:

- See Dividend Discount Model for dividends in non-binomial tree model

- Total Return (incl. dividends):

- Capital Gains Return (excl. dividends):

- (Dividends Return )

Assumptions & Definitions

- Log returns: Is also a random variable

- Log normal is another indicator of how well the stock is performing

- It is similar in value to the percentage return

- See What does the average log-return value of a stock mean? - Personal Finance & Money Stack Exchange for the intuition

- i.e. the stock ticking up then down is same as no movement at all

- Instantaneous Rate of Return

- Drift: Instantaneous Expected Log-Return

- Log Variance: Instantaneous Variance of Log-Return = Volatility ()

- Dividend Rate

Lemmas

- (Proofs in notes)

thm. Parameter Triple. Given a security with we determine that:

Continuous Time Model

Model Definition

Instead of assuming an uptick-downtick gross return is a Bernouilli Distribution, we instead think of the log returns. (Use Lindenberg CLT)

⇒ Thus we have

Properties

- is a lognormal random variable

- i.e. where is the standard normal random variable

- are i.i.d.