Motivation. A trade involving millions of dollars probably should be executed properly and not by some web app. Thus a trade is made not simply by a market order on an exchange. Also, a random person can’t go up to an exchange and trade a security. Thus a trade must be made:

- Through an Investment Bank who has a seat at the table at an exchange

- Go through multiple confirmations by both parties to ensure accuracy

- Settled via an escrow eventually

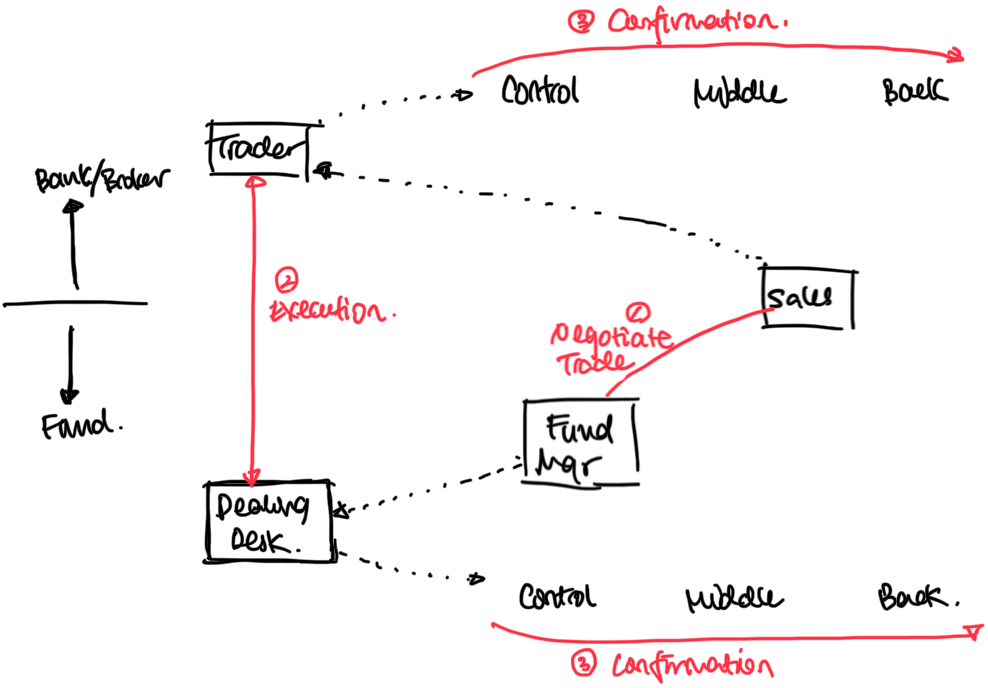

def. The Lifecycle of a Trade is the process by which a trade is negotiated, executed, confirmed, and settled. Example. Imagine a fund manager wanted to buy $1M worth of AAPL shares.

- Negotiation. Fund manager approaches the sales team of a bank, and negotiates the price, volume, etc.

- Normally it’s any institutional investor like a fund, or High Net-worth Individual (HNI).

- Validation & Confirmation. Both fund manager and sales team tell their trader/dealing desk about the agreement. The two communicate with each other to execute the trade.

- Both do due diligence (“Know Your Client”, risk analysis)

- Both the fund and bank have systems in place to make sure the trade isn’t suspicious, is at the correct price, etc.

- Settlement. The money and securities are transferred in a central escrow called the Clearinghouse. def. Clearinghouse/Central Securities Depository (CSD). An entity that:

- Keeps track of which banks/brokerages/funds have which securities

- In case of individuals, brokerages keep track of how many each investor has

- Acts as Escrow for trades