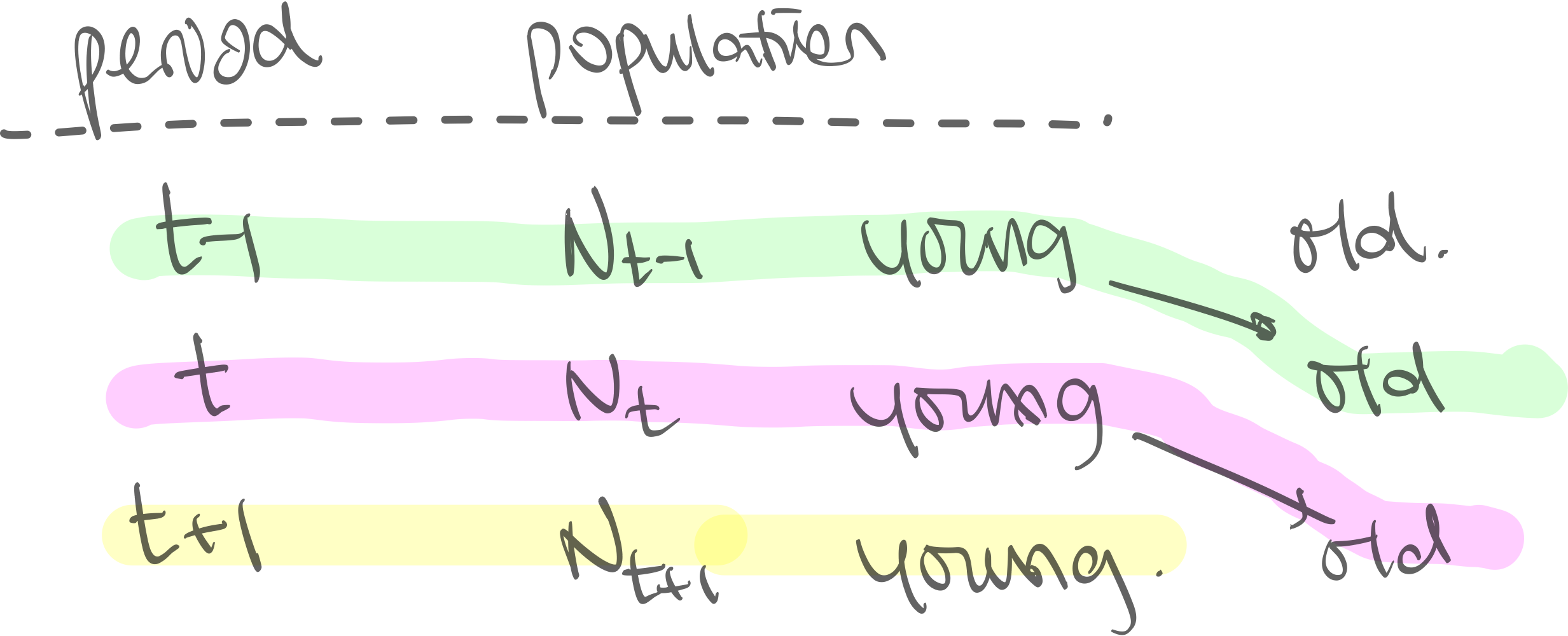

Motivation. We pay for social security by taking money from the young and giving it to the old. The payment framework for a three-period social security is:

let

let

- population grows by rate

- young will pay lump sum per capita

- old will receive lump sum per capita then consider period :

Household Intertemporal Pension Optimization

Variation of Household Intertemporal Consumption Only Optimization. We have

- : income at time

- : interest rate. ass. perfect Financial Markets.

- : lifetime wealth, value at time Then we have budget constraint for a houshold young at time :

The last term, NPV of retirement income is positive when , i.e. when population growth outpaces interest rates. if not, then instead of social security one should invest in the capital markets (i.e. 401(k) policies, etc.) to use to grow their money.