Autoregressive

Motivation. You want to predict a time series, e.g. milk consumption per month. It is the most natural to say “future value is a weighted sum of past (realized) values.” The autoregressive model formalizes that.

def. Autoregressive Process of order . (). is an process if it is modeled

where which is called “innovation,” the “new” factor or information. Intution. Current value is the weighted sum of past values, plus some new thing that happened this time.

Moving Average

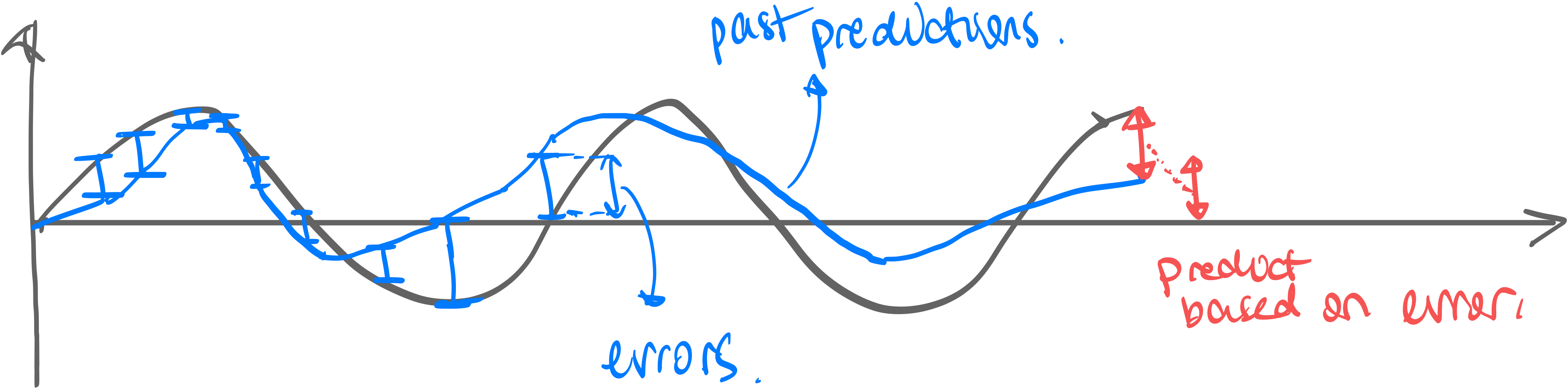

Motivation. But you might consider a more intelligent model, which is able to look back at the prediction errors in past data to predict current data.

def. Moving Average Process of order . is a process if it is modeled:

def. Moving Average Process of order . is a process if it is modeled:

where . We can also get its theoretical ACF as:

Intuition. Current value is the weighted sum of past innovations and nothing else.

ARMA

Now for the kicker: def. Autoregressive Moving Average process of order . is an process if it is modeled:

Invertibility, Causality

thm. ARMA causality/invertibility condition. let process as above, and let:

now, if:

- has no common roots

- has roots outside the unit complex circle i.e. → Causality

- has roots outside the unit complex circle i.e. → Invertibility If causal, this process is causal with coefficients obtained from the following:

Example. has form , with , and complex polynomials:

And , so we have a causal form. The coefficients obtained by:

Thus the causal form is:

ARIMA

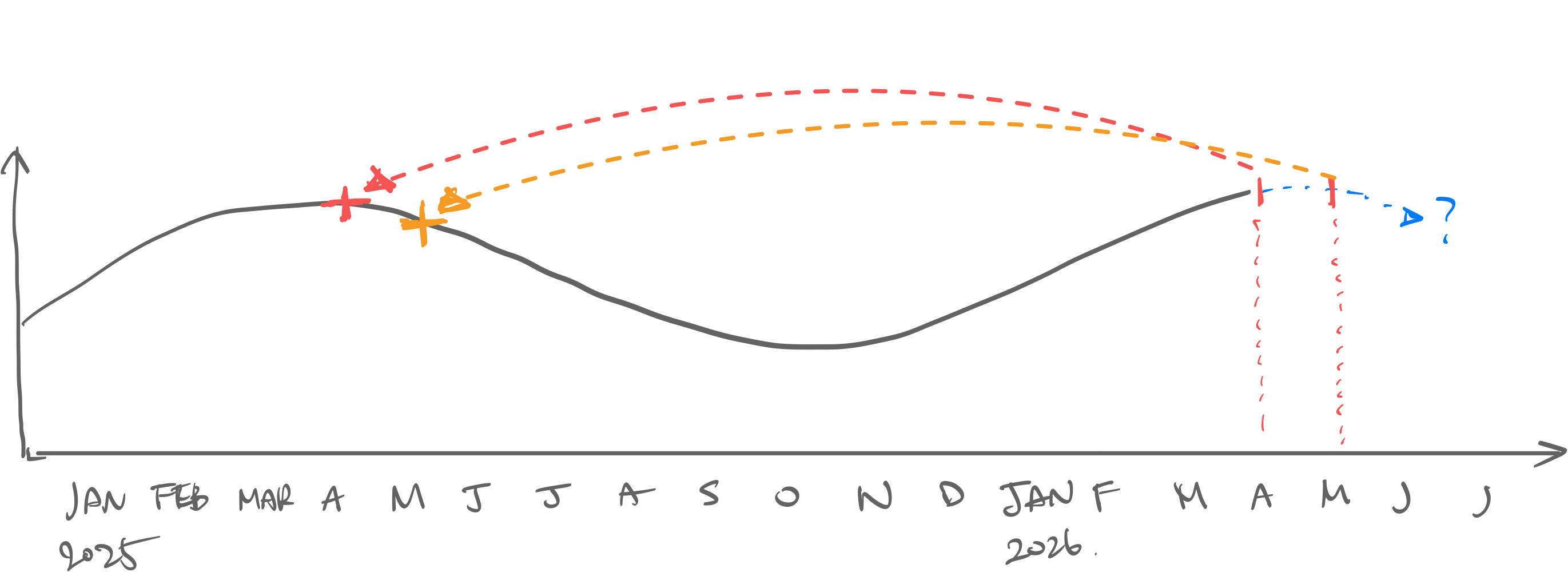

Motivation. Problem is when there is “drift” (=data generally moves up). This is corrected by using not the time series itself, but the “difference series” of that time series. def. Difference Operator. For process the difference operator is defined as:

- this has nothing to do with the gradient operator in calculus Now we can define: def. Autoregressive Integrated Moving Average (ARIMA).

- We have some series that keeps on drifting

- Sowe difference it times, and got a new time seiries

- can be modeled as a time series.

- Then, is a time series Example. Let price of security , and log-prices . Then obviously the log-returns is the difference series . If the log-returns series can be modeled as an then the original log-prices is an model.